What are your personal criteria when you intend to buy a property? Location, price, infrastructure, footage, availability of repair — the list may be endless. Roughly speaking, you collect all information of your interest, analyze it, and decide in favor of this or that property.

That’s exactly the algorithm real estate companies follow. They make property deals and elaborate future strategies guided by information. However, there is a huge difference hidden in the amounts of data sets subject to analysis and deal volumes that may reach billions of dollars.

That’s one of the biggest headaches and reasons why companies resort to real estate software development services — efficient data collection, management, and analysis. In this blog post, let’s take a closer look at data-related hurdles faced by real estate companies, and why robust property management data analytics is of critical importance to go ahead of the rest.

Piles of Data. A Curse or a Blessing for Real Estate Companies?

The more data you have — the more precise analysis you are empowered to conduct. From this standpoint, data is a real blessing, helping in informed decision-making. However, there are always two sides to the coin, and let’s consider one of our case studies to have a better understanding of data-related issues.

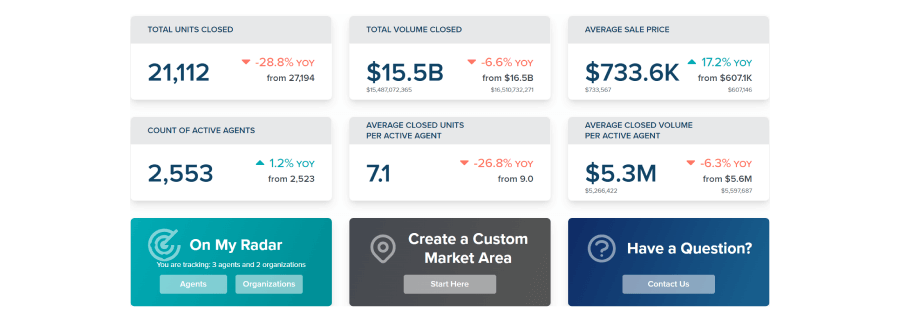

Our client, who provided data and consulting services to real estate companies, turned to us with the request to supplement their existing solution with a powerful analytics tool that would generate reports on sales activities.

The issue is that they pull various data from Multiple Listing Service (MLS) databases. Their amount is literally immense, reaching up to 400, and they contain details about real estate offices and agents, average property prices, and units closed

The United States doesn’t have a centralized real estate portal, where you are empowered to find data about properties located at different corners of the country. Although there exist national real estate websites, such as Zillow or Redfin that aggregate data from multiple MLSs, they may not have all the listings in comparison with local MLSs. Each region or zip-code address is confined to a particular Listing Service, and it contains information on the properties located there and nowhere else.

Imagine the scope of data that our customer operates. Each MLS is a separate data source, with rows and rows of heterogeneous information that doesn’t bring real value separately. It must be aggregated and analyzed to help the company’s clients make informed strategic decisions and evaluate potential deals more precisely.

Explore more details on the delivered Real Estate Data Analytics Solution

From this point of view, huge volumes of data are a real headache, or rather, the approach they require to bring tangible value. Below, let’s review some types of data real estate companies may require for effective interaction with their clientele and deals closing.

Financial Data

- Company’s financial performance for the requested period

- Property evaluation details

- Mortgage interest rates and terms

Geographical Data

- Location of properties

- Nearby infrastructure and the presence of green areas

- Air pollution and noise levels

Real Estate Market Overview

- Historical and current property prices

- Data on competitors’ proposals

Client Data

- History of interaction with clientss

- Clients’ preferences and testimonials

Operational data

- Properties’ technical condition and energy efficiency

- Data on renovations and maintenance

Turning Rows of Words and Numbers into a Valuable Asset or Why Real Estate Needs Data Analytics

The list of potentially needed data isn’t exhaustive and varies depending on the specific information each client wants to include in their reports. In this part, let’s explore some examples where data analytics for real estate can be of great help.

Real Estate Agents’ Performance Monitoring

If you are a business owner, you, like no one else, understand that a properly formed team is already half a success. With the power of data analytics for real estate, you can easily track the performance of your agents separately or evaluate and compare the efficiency of your offices (if you run several scattered across different regions).

With proper analytics tools incorporated in your software, you are empowered to track your agents’ KPIs, such as sales volume, average income from deals for selected periods, client satisfaction score, time taken for deal closure, and more. The list can go on, depending on which metrics you want to behold in your reports.

Marketing Materials Generation

Puzzle over how to improve your marketing? Real estate data analytics can also do a great job here. Let’s see how exactly.

Agree, you are unable to see the percentage of successfully closed deals and total client satisfaction score without any statistics. However, such data could be of great use for brand awareness and marketing promotion.

Say, your analytics showed that for the previous year, your agents closed deals for 50 million dollars, and according to feedback, your customer satisfaction score exceeded 90%. Why not share these impressive results on your social networks or printed brochures?

The system can easily and quickly aggregate these data and visualize them in digestible and eye-pleasant graphs. Imagine, how long it would take if you proceed with the manual analysis of all the testimonials, deal sizes, and subsequent visualization.

Gaining Control of Customer Engagements

What if every customer could deal with your single most effective sales or service person?

Precise Property Evaluation

You can’t close a successful deal without a precise assessment of the property you intend to buy, sell, rent, or lease. Obviously, pulling this task off without piles of various data is an impossible mission.

Property’s technical condition and its history, location, energy class, and risks related to the possibilities of natural disasters — all these factors must be considered when defining its cost. If you entrust it to a human, there is a high possibility of missing seemingly minor but, in reality, essential details that may result in incorrect price definitions, which in turn carries material risks for the company.

Personalized Offerings

Personalization has become a new normal. At the very beginning of their journeys, clients expect companies to factor in their desires and preferences. And again, here you can’t do without data.

Previous interactions with customers, their past experience, testimonials, and preferences — all these details are a real treasure for a service provider. With robust data analytics in real estate, you’ll be able to form a portrait of your client and align with their expectations when granting offerings. Such an approach is a great opportunity to boost existing customers’ loyalty and acquire new ones. Remember, word of mouth is the best advertising ever.

Discover how to Transform Your Business with an Effective Data Analytics Strategy

So Tough, So Easy. Why Real Estate Data Analytics Is Far from Simple

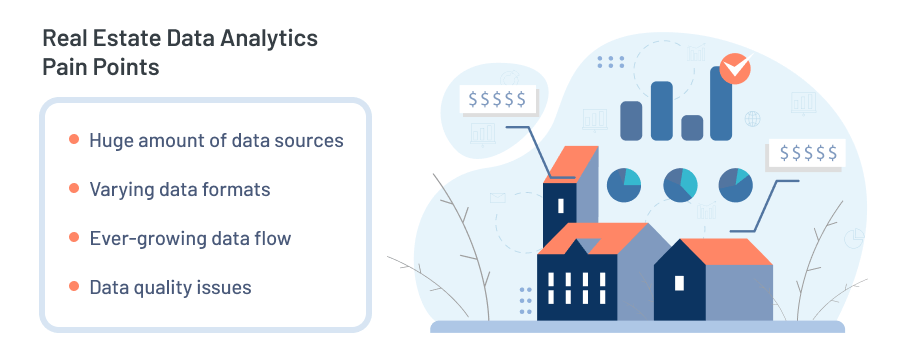

Immense Number of Data Sources

Let’s refer to the example with our customer operating data from multiple MLS. As it has already been mentioned, the amount of listing services is really huge which is a challenge in itself.

Why? Because to access data from these sources the customer has to configure integrations with each and every external database. When proceeding with API development and integrations, there exist multiple things to keep an eye on: starting from ensuring data consistency and ending up with maintaining the stable performance of your application.

In addition to the numerous technical complexities and intricacies that must be taken into account when dealing with integrations, you shouldn’t discount significant costs. Each integration implies expenses, so that’s simple: the more sources you want to gain data from —- the more you have to pay.

Varying Data Formats

This kind of hurdle is closely intertwined with the first point where we mentioned the amount of data sources. Considering MLS, even though the information type is more or less similar, the formats may be different initially or can be changed over time.

Therefore, it’s impossible to use data in disparate formats centrally. Or you can, but it comes with significant limitations and multiple hurdles since the formats are incompatible with each other. That’s why we leverage well-vetted ETL processes to transform files into a unified format and maintain data consistency.

Ever-Growing Data Flow

Operating huge volumes of data, don’t forget that the flow doesn’t become smaller over time. Exactly the opposite, your business grows — you expand your client base, make new deals, store the information about the past ones, make forecasts, and so on. Therefore, you accumulate data non-stop and don’t want it to affect the performance of your existing system.

Unfortunately, it happens that scalability configurations fade into the background, and over time, the server load may become huge, so it can’t process such data volumes. Exactly this happened to our customer when they cooperated with the previous vendor.

When we got down to the project, the pages’ load time was not seconds but minutes, which was totally unacceptable. Our engineers had to rewrite data request code, add indexes and caching to optimize server load, and establish stable system performance.

However, it would have been more reasonable to fine-tune system scalability much earlier, when it became clear that data flow would only grow. Thus, all the performance issues could be avoided.

Data Quality Issues

Humans are inclined to make mistakes or overlook typos. Since all data sources imply people’s involvement, it’s not a surprise if some details are entered incorrectly. For example, when typing the date, a human may accidentally swap day and month, make a typo in the property address, or put a dot in the phone number.

Roughly speaking, mistakes can be anywhere, and they are inevitable. That’s why our best practice here is to involve QA engineers to write autotests that would detect data anomalies and give alerts. Therefore, thorough data quality testing helps to ensure that our customer gains clean and well-checked information for data analytics in real estate.

Of course, it happens that the process of data extraction may go awry itself. Some data may be downloaded poorly or only partially, such troubles also occur. For example, we prepare our statistics on dismissed real estate agents for 2024. Previously, the number of employees that quit their jobs was approximately 100-150 for the past years.

But here we notice that the company lost 2000 agents for this year. This can hardly be real, therefore, something went wrong at the stage of data extraction and transformation. Thus, it’s essential to strictly monitor such deviations and take immediate measures to get the ETL process back on track.

Read about 6 Types of Data Analysis That Help Decision-Makers

Predictive Analytics Matters. Why ML Is an Indispensable Tool and What Affects Forecast Precision

Predictive analytics is important for the real estate industry for many reasons. Anticipate market movements and seasonal trends, foresee possible risks, define investment strategies, and elaborate financial plans — that’s only a partial list of where predictive analytics can be of great use.

But how to make it happen and create precise predictions in the shortest possible time? With the magic of well-trained Machine Learning algorithms, of course. However, there is one important subtlety we can not fail to mention.

And this is the amount of data. Imagine that you are thinking over property investment and need to evaluate it. To do that, you leverage only current details related to location, nearby infrastructure, and size and disregard historical data, such as past natural disasters, previous maintenance works, and so on. Will the assessment be accurate with such a limited amount of data? Apparently not.

The more data you leverage for your ML model, the lesser the probability of being mistaken in the property assessment you have. When using big data analytics for real estate, the algorithms will consider all the details, even seemingly minor ones, so you can gain the full picture and make informed decisions related to acquisition management and beyond on its basis.

Concluding Lines

Countless rows of heterogeneous data do not bring any value by themselves. Information must be carefully extracted, cleaned, and visualized to be turned into a precious asset and bring profit in the long run.

Real estate companies understand the complexity of this process. The challenges posed by large data volumes, data quality, and performance issues can impact the accuracy of analytics. Therefore, adopting the right approach for data analytics in real estate is crucial for success.

At Velvetech, we have an experienced team of engineers that has delivered multiple solutions for the real estate business. Drop us a line, we’ll gladly help you turn your data into valuable insights!