Imagine a world where you had to physically visit a bank to deposit a check or withdraw cash. First, you need to wait in long queues, then fill out paper forms to transfer or check out money. Today, it sounds like a distant memory.

BaaS became especially popular during the pandemic and is still a trend nowadays. The BaaS market size is predicted to reach around USD 12.2 bln by 2031. Hence, it is definitely one of the financial solutions that it is worth keeping an eye on.

In this article, we will discuss the pros and cons, use cases, and future trends of banking as a service. It will help you have a clear picture of what your business will gain after employing BaaS.

What Is Banking as a Service and How Does It Work?

Before delving deeper into the realm of BaaS, let’s first answer the question: what is banking as a service?

Well, BaaS is an ecosystem that enables non-banking enterprises to offer financial services and products through API technologies or platforms. Basically, this process empowers businesses to include an array of banking operations in their own products without becoming full-fledged banks themselves.

Here are the various types of BaaS solutions you can incorporate into your products:

- Credit and debit card processing

- Account and wealth management

- Investment

- Digital transactions

- Online banking

- Credit financing

- Customer support

- Product management

- Risk assessment

You may wonder how non-financial companies smoothly integrate these services. As we said, banking as a service ensures a secure connection between regulated banks, licensed financial institutions, and non-banking companies. It is a win-win option for both customers and businesses.

There is no need for clients to switch to a bank’s website or application to get needed services or access their online wallets. They can simply do it with the app that incorporates BaaS technologies. As for business advantages, we will discuss them deeply in one of the upcoming chapters.

Key Players of a Winning BaaS Solution

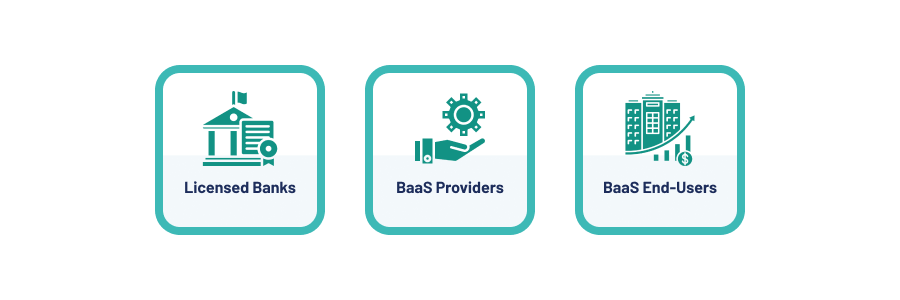

Though crafting a winning BaaS solution can seem easy, it requires a strategic combination of fundamental elements. Here are top players required to create a winning BaaS proposition.

- Licensed Banks. A BaaS provider needs a bank license to access financial products. As a result of integrating with banks, BaaS offers relevant functionality to its consumers.

- BaaS Providers. These are the companies or organizations that offer BaaS solutions. They develop and maintain the infrastructure, software, and tools that are needed to deliver specific business services. They ensure that BaaS services integrate and work smoothly with other applications and technologies in a business.

- BaaS End-Users. These are the companies that use BaaS solutions to employ various financial services. Basically, they rely on a banking-as-a-service provider to implement financial tools. However, in some cases businesses can leverage their own in-house development and management resources to build BaaS solutions based on their specific needs.

BaaS in Practice: Real-World Use Cases

From lending solutions to investment tools, BaaS allows a wide range of industries to leverage the power of banking services and expand their offerings. To boost your confidence in implementing BaaS and gain a better understanding of how BaaS can be beneficial, let’s explore some real-world examples.

Fintech Startups

Banking as a service platforms are a foolproof option for fintech startups to streamline and simplify various financial processes. There is no need to build a payment or other solutions from scratch. It’s a perfect option for companies to save time and money.

Take Square and Robinhood, for instance. They collaborate with BaaS providers to seamlessly integrate features such as instant deposits, withdrawals, and real-time trading execution.

Keep reading to discover Key Pillars of FinTech Software Development

E-Commerce Platforms

BaaS solutions are actively used by e-commerce. They integrate banking as a service into their platforms to offer a wide range of financial services. For example, Shopify, one of the most prominent e-commerce platforms, collaborates with BaaS solutions to provide capabilities for entrepreneurs and buyers to manage payments, refunds, and financial reporting within their online stores.

Gig Economy Platforms

BaaS solutions are actively integrated by gig economy platforms. Typically, they include ride-sharing and food delivery apps, which are very popular today. As a rule, they employ BaaS to facilitate rapid and secure payment transfers for their employees.

Take for instance, Uber — one of the pioneers of ride-sharing apps. It integrates BaaS to enable drivers to get rapid earnings right after completing rides.

Neobanks

Neobanks, also known as digital banks, operate solely online. They offer digital, mobile-first financial solutions such as payments, money transfers, lending services, and the like. And one of the key factors driving their success is their utilization of banking as a service.

BaaS empowers neobanks to offer a wide range of services while focusing on a seamless and customer-centric digital experience. Chime, for instance, is a neobank that collaborates with BaaS to offer consumer banking services through its mobile app.

Another good example is the global neobank Revolut. With banking as a service, it enables multi-currency accounts, cryptocurrency trading, and international money transfers for its large user base.

Key Benefits to Reap from BaaS

As promised, in this chapter, we will delve deeper to discuss key advantages that businesses can harness from BaaS solutions. At its core, banking as a service opens many opportunities for companies. Here are the key reasons why BaaS is worth your time and effort.

Cost-Effectiveness

Cost-effectiveness is probably a dream for many entrepreneurs. If you want to implement innovative financial products and services without the complexity of building banking infrastructure on your own, BaaS can serve as a captivating solution.

You can simply employ pre-built and scalable infrastructure, thus saving resources that would otherwise be spent on extensive development and compliance efforts. This enables you to focus on leveraging existing financial products and provide your customers with a better experience.

Faster Time-to-Market

Falling behind in the market can lead to missing out on crucial opportunities. Just as the early bird catches the worm, businesses that utilize BaaS can seize the chance to deliver innovative financial solutions swiftly.

Typically, banking as a service platforms offer a range of financial services, such as payment processing, account management, or compliance tools, that are ready to be integrated. It significantly reduces development timelines and lets businesses market their products faster.

Discover other crucial steps to Build a Market-Revolutionizing FinTech App

User-Friendly Interface

Regardless of the opportunities that your product offers, if it is hard to employ, users may probably refuse to adopt it. That is why, many BaaS solutions come with a user-friendly interface. They support responsive design and provide strong focus on accessibility to cater to a diverse user base.

Consequently, to ensure a seamless customer experience, BaaS platforms should be built with customer-centric UI/UX design in mind.

User-Driven Approach

Watch our webinar and learn the top ways of reducing poor user satisfaction, low adoption rates, and decreased loyalty.

Emerging Trends

The fintech industry is constantly changing to align with new trends and technologies. And BaaS platforms are designed to quickly adjust to these changes.

Basically, banking as a service providers continually update their offerings to incorporate the latest technologies and industry trends. So, by adopting BaaS, you can access the emerging trends without having to invest heavily in research and development.

Learn more about Top Technology Trends in Business to Focus on 2024

Global Reach

BaaS empowers businesses to expand their services beyond their local or regional boundaries. It’s all because many banking as a service offerings are built on cloud computing infrastructure. Cloud-based solutions can be accessed from anywhere in the world, making financial services available to a broader audience.

Discover how to Cut Your Spending and Optimize Cloud Costs

On top of that, BaaS platforms typically support multiple currencies and payment methods. Thus, enabling businesses to provide a seamless experience to customers regardless of their location.

Access to a Banking License

Usually, to offer financial services, you need to obtain a banking license. It can be overwhelming, as it requires stringent regulatory standards and tough paperwork. Fortunately, BaaS suggests a simple yet effective solution for this issue.

Banking as a service allows non-banking companies to collaborate with licensed institutions, leveraging their existing infrastructure, expertise, and regulatory approvals. As a result, non-financial companies can offer financial services without the need to go through the complex and resource-intensive process of obtaining a license.

Considerations to Think About Before Implementing BaaS

While banking as a service offers numerous advantages, like anything else, it also comes with certain considerations. To unlock its full potential and ensure successful implementation, here are some pitfalls to avoid before embarking on your BaaS journey.

Data Privacy and Regulatory Compliance

Each industry requires specific compliance regulations. So, before implementing banking as a service, make sure that your chosen provider complies with them. Otherwise, you will face legal consequences, suffer data breaches, lose the trust of your clients, and put your business reputation at risk.

For example, if you operate in the healthcare industry, then you need to choose a banking as a service solution which complies with HIPAA (Health Insurance Portability and Accountability Act) regulations. Or, if you run an e-commerce business in Europe, then probably you will need a provider which will follow regulations like the GDPR (General Data Protection Regulation), etc.

Discover more about HIPAA-Compliant App Development

Customization Limitations

BaaS solutions can not always appear a good match for every company. Banking as a service technologies are intended to serve a large number of clients, therefore they provide a standardized set of services and features. As a result, they may not always cater to businesses individual needs.

Though companies with special requirements can adopt BaaS, they may still require additional customization to align with their demands. Such processes can be both costly and time-consuming.

Vendor Dependence

When businesses use banking as a service solutions, they rely heavily on a provider for important activities like storing data or handling transactions. Because of it, the company may become overly dependent on the BaaS accessibility, performance, and security practices.

When a BaaS provider experiences technical challenges, downtime, or even a security incident, the businesses that rely on their services may experience significant inconvenience too.

Future Trends and Outlook for Banking as a Service

Banking as a service is a rapidly growing industry that transforms the way we manage our assets. This innovative approach has already reshaped the financial landscape and will undoubtedly continue its evolution in the future. So, now let’s explore some cutting-edge technologies and emerging trends that will keep propelling BaaS forward.

AI-Powered Solutions

AI-powered BaaS solutions use complex algorithms to handle massive amounts of real-time data, giving personalized financial services to individual consumers. With the help of artificial intelligence, it is possible to monitor customers’ spending behavior and make personalized investment management suggestions based on their financial goals.

On top of that, by utilizing AI tools, BaaS solutions can empower businesses to communicate with their clients more efficiently. For example, companies can provide 24/7 customer service by using chatbots to answer client questions and resolve issues in real time. Probably in the future, these chatbots can understand and respond to complex queries and perhaps even predict customer needs proactively.

Learn more about the Benefits of AI in Business

Blockchain Integration

Blockchain is another prominent future trend in the realm of BaaS. Blockchain technology offers several compelling advantages, like robust security features, transparency in transactions, low costs for cross-border payments, etc.

By leveraging blockchain, banking as a service providers can implement robust mechanisms for identity verification, ensuring that customer data remains secure. Blockchain can also serve as a powerful tool for reducing fraud and unauthorized access, instilling trust and confidence among both financial institutions and their customers.

Discover how Blockchain Revolutionizes the Banking Industry

Financial Inclusion

Financial inclusion stands at the forefront of future trends in banking as a service. Through BaaS, banking services can be available to individuals and communities previously overlooked by traditional banking institutions.

Nowadays, even people who live in a remote village where there’s no physical bank nearby can reach banking services through BaaS using their phones or tablets. Consequently, financial services will be accessible to everyone, regardless of their location.

Tap into the World of BaaS

Thanks to BaaS, you can accelerate your revenue streams, expand your market niche, and enhance customer experience. There is no need to be overwhelmed with financial software development and create everything from scratch.

If you are on your way to build a solution and integrate banking as a service but have some trouble, Velvetech is ready to guide you. With our extensive expertise and experience, we will help you harness the benefits of BaaS tools.

Feel free to contact us.