Despite being in its early stages, blockchain technology is already revolutionizing multiple industries. From banking and retail to gaming and entertainment, it seems like everyone is expressing an interest in this innovation.

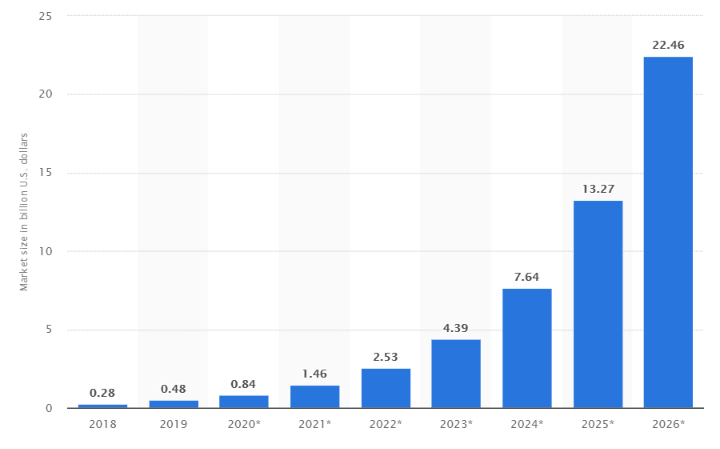

However, one of the top blockchain uses is definitely in the financial services industry. With the blockchain in finance market size expected to reach $22.5 billion in 2026, it is clear that there is a lot of potential for growth in this area.

Given how promising blockchain is for the financial sector, we’ve decided to dive deeper into the subject and provide you with some key things to know about the technology’s use in this industry.

We will start by understanding what blockchain is and what benefits it can bring to finance companies. Then, we’ll move on to discussing blockchain use cases in various sub-sectors of the finance industry and finish up today’s article by briefly touching on blockchain regulations. Let’s get started.

What is Blockchain?

Blockchain is a digital ledger for recording transactions. Essentially, it’s a decentralized, distributed, and secure database that allows blocks of information to be stored in a chain. The technology first gained a lot of popularity in 2009 when it was used to launch the Bitcoin cryptocurrency.

Find out How to Create Your Own Crypto

Currently, the technology is already disrupting various industries, including finance, healthcare, retail, insurance, and it shows no signs of slowing down. The advantages of the technology attract the key players of these industries and motivate them to invest in blockchain development despite it being in a nascent stage.

Benefits of Blockchain in Financial Services

Blockchain development services are growing in demand all around, but especially in finance. This isn’t surprising, considering the benefits they can deliver to financial institutions. Let’s take a look at each of them.

Security

Currently, the financial industry is quite centralized and transactions have to go through various intermediaries to be carried out. This not only creates bottlenecks and data safety risks but also contributes to a lack of transparency within the system.

Blockchain significantly reduces the risks that can come from intermediary participation and centralized databases. Since the technology is distributed, it provides more opportunities for secure workflows than traditional systems that are more vulnerable to hacking attempts.

Moreover, thanks to transaction ledger’s being encrypted, only the individuals with their unique key codes can access data. This makes blockchain particularly appealing for those involved in financial operations.

Transparency

As we’ve just mentioned, the use of blockchain in finance eliminates or, at least, decreases the need for intermediaries’ involvement. That way, it helps elevate the transparency between financial institutions and improve regulatory reporting.

Additionally, central banks are researching ways to leverage blockchain and build new systems for data sharing between related participants, which enhances monitoring and adds visibility to the process.

Reduced Costs

Intermediaries like financial advisors, brokers, agents, and others, all charge fees for their services. Thus, once middlemen are removed — you significantly reduce operational costs.

The Ethereum blockchain, for example, is particularly popular for its smart contract capabilities. Due to them, agreements can be executed immediately once predefined criteria are met. This cuts out intermediaries and the associated commission costs.

Lower Risks and Errors

Another benefit of using blockchain in banking and finance, in general, is the ability to control risks and reduce errors. The technology makes it possible to settle transactions quickly and record them, which helps control fund management and credit risks.

On top of that, as there are fewer intermediaries involved in the process and any data is recorded, there are fewer chances to face any errors made by humans and more ways to trace and handle them.

Efficiency

As previously mentioned, blockchain eliminates the need for middlemen. However, besides reducing costs and improving security, it also leads to much higher efficiency. There’s no longer any need to spend time dealing with intermediaries and waiting for them to get everything in order. Instead, things can be carried out way faster.

As you can see, blockchain-based fintech can bring valuable benefits and is definitely a technology that shouldn’t be underestimated. So, if boosting security, cutting down recurring fees, and improving efficiency is something that interests you — keep reading to discover the key ways to leverage blockchain in the financial industry.

Use Cases of Blockchain in Finance

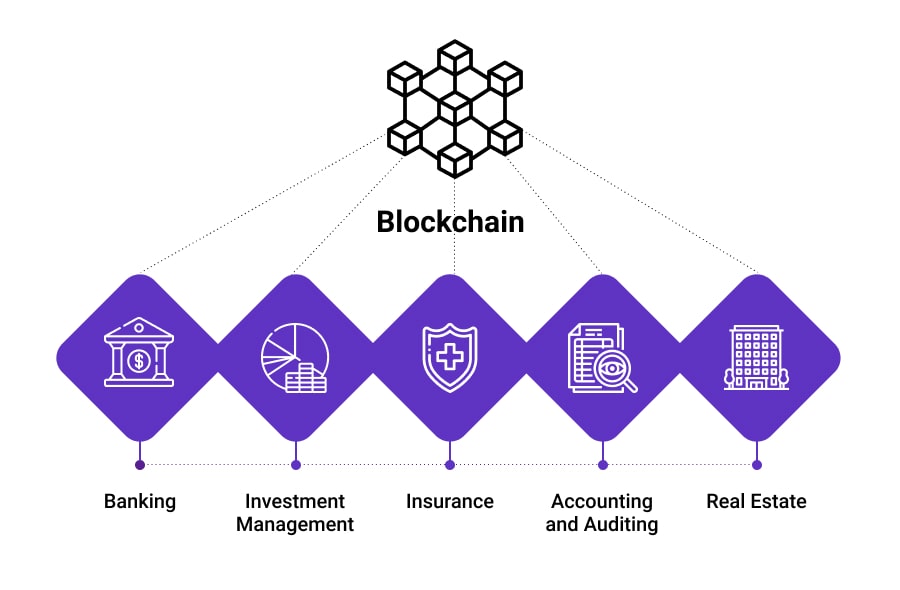

So how is blockchain used in finance? Today, we will cover five key sub-sectors of the finance industry — banking, real estate, insurance, investment management, as well as accounting and auditing. Let’s take a look at the main applications of the technology in these five areas.

Banking

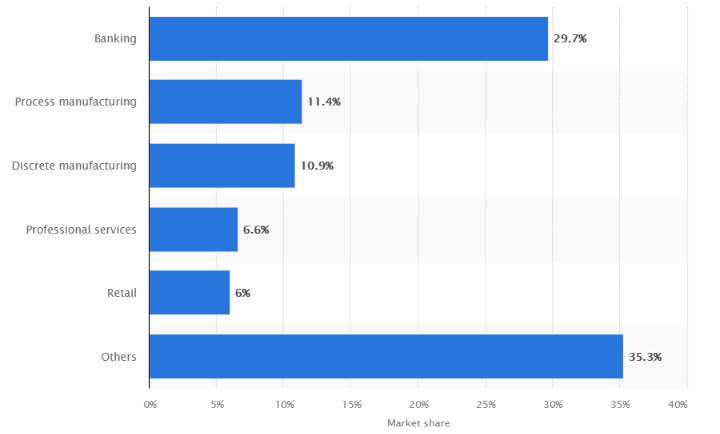

Banking is likely an area that can benefit the most from fintech. In fact, in 2020, almost 30% of the global blockchain market revenue was distributed towards banking.

So, which banking operations can take advantage of blockchain? Here are the main ones:

Recordkeeping. One of the primary blockchain uses is centered around storing data. The technology can help finance companies securely store all of their important information and allow access only to relevant personnel.

Payments. Instead of facing the challenges that come with traditional money transfers, banks can leverage the technology and use it as a key differentiator to gain a competitive advantage. Specifically, by helping save time and reduce transaction fees, banks can improve their service offerings and win more market share.

Loans. Currently, loans are given out after underwriters review the credit history of the client. As you can imagine, this can take some time and exposes the financial institution to some security risks. However, with loan origination software powered by blockchain, it can all happen faster and in a much safer manner. Due to its decentralized nature, customers don’t have to worry about their information getting leaked and can have their loans approved more quickly.

Discover How Banks and Financial Institutions Should Use Intelligence Tools in 2022

Truth be told, there are many more applications of blockchain in banking. After all, business operations are vast in this field. For now though, let’s move on to the next use case.

Real Estate

Completing real estate transactions through digital channels has never been common. Instead, they usually involve various face-to-face encounters, discussions, and contract signing. As you may guess, thanks to blockchain, it no longer has to be that way.

Smart contracts are already revolutionizing real estate’s financial transactions with their recording and property ownership transfer capabilities. With the help of a smart contract, individuals don’t have to involve any third parties like lawyers, brokers, or banks to complete their transaction.

With blockchain, the two sides involved in a real estate agreement can simply use a smart contract to transfer the property and the money in a transparent and secure manner.

Insurance

Insurance is an area that is often subject to fraud. Thus, claim settlements can take a long time and eventually drive away customers. Luckily, blockchain can streamline the entire processing time and simplify claims management. Once again, smart contracts come into play and automate settlement processes and insurance payments.

Similar to banking, blockchain in insurance can also enhance the security of sensitive information. Since insurers rely on extensive data to issue policies, it’s important to keep it safe. Blockchain’s encrypted and decentralized nature reduces the likelihood of corruption or manipulation and can leave both — you and your customers — feeling at ease about the security of all the stored data.

Learn why it’s time to consider Insurance Agency Management Software Development

Investment Management

We’ve mentioned several times that blockchain is at its nascent stage. However, its disruptive potential is being discussed all around. For example, Deloitte’s team is convinced of the technology’s portfolio management abilities:

“For investors looking for increased transparency beyond what their Financial Advisors can provide, blockchain could offer real-time (eventually to the minute) visibility into positions to better analyze portfolio exposure/performance.”

— Deloitte

Also, one of the best ways for investment firms to ensure their funds go into the right hands is to turn to cryptocurrencies. That way, there should be no trouble maintaining investment ledgers and validating accounts. So, if you’re in the investment business, consider exploring how financial software development can help you grow.

Accounting and Auditing

We’ve already established that blockchain has the potential to simplify all recordkeeping with its distributed base. However, it also can have a significant impact on auditing. Since auditors go through the process of verifying accounts and finding inconsistencies, the procedure can get rather cumbersome and time-consuming.

With blockchain, everything is simplified. By adding records directly into the ledger, data is stored and updated much more efficiently. Moreover, the ledger can provide proof of fund transfers in real-time that’ll serve as indisputable evidence due to its transparency and accuracy.

Regulations of Blockchain Technology in Finance

Before jumping into the development of your blockchain solution, it’s essential to talk about regulations. Currently, the technology is rather new and unfortunately, regulation is non-existent in some countries. Everyone is just in the process of figuring it out.

The decentralization aspect of blockchain creates difficulty for governments and central banks. Since authorities can’t fully supervise assets like Bitcoin, some feel their control is threatened with this innovation.

Despite the murky laws forcing some organizations to postpone the development process, the financial services industry can still benefit from this technology.

Hence, if you’re serious about building a blockchain tool for your finance company, you’ve got to review the specific regulations in your country. After all, lack of compliance can result in prosecution and unnecessary fees.

Should You Get Started With Blockchain Development?

The future of blockchain in finance seems quite bright as it’s gaining more and more traction every day. Businesses are eager to leverage the technology to have more security, reduce costs, and boost efficiency. Even with some regulation concerns — blockchain remains a hot topic of discussion for major players in the industry.

So, if you’re thinking of starting your fintech development journey, you might be wondering where to begin. Of course, if you have a strong in-house development team with blockchain experience, you can set out the goals and begin the work. However, many financial organizations lack specialists in this area. In that case, it’s best to turn to custom development services.

The cost of developing custom blockchain solutions will vary depending on your needs. However, you’ll be able to get a product that’s truly unique to your business and solves its specific challenges. So, make sure to consider it as a way of moving forward with your project.

At Velvetech, we’re excited about the future of blockchain applications and their use cases in finance. Our team has extensive expertise in distributed ledger technologies and is always ready to take on innovative projects. So, don’t hesitate to contact us if you’d like to start your blockchain development process.