Investment applications have become a powerful tool in recent years, altering the way individuals manage their finances. The reason these apps are so enticing is that they allow people to control their financial assets anytime and anywhere.

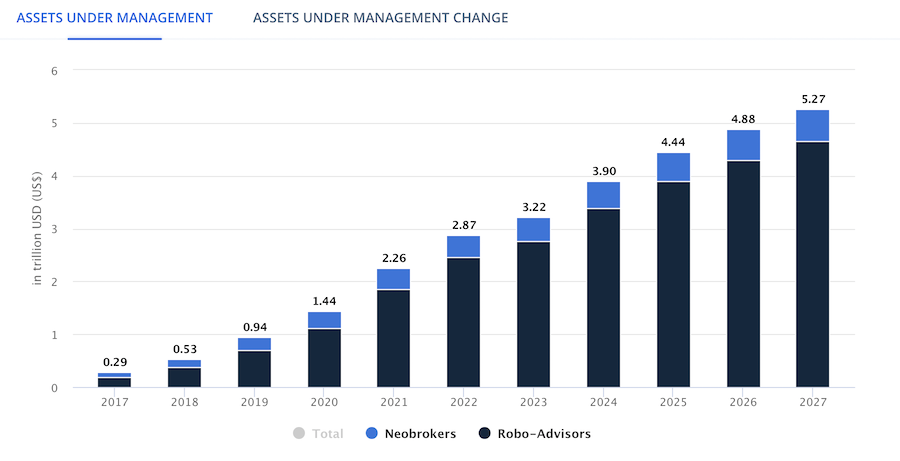

The digital investment market is experiencing rapid growth with a projected global value of US$5.27 trillion by 2027, according to Statista. With this forecast in mind, it is clear that this market is going to remain highly competitive and yet very lucrative. Hence, if you aim to gain an edge in this market, you definitely shouldn’t overlook the development of an investment application.

In today’s post, we’ll explore the essential steps you should take to create an investment app, ensuring you leverage its full potential. To make your solution financially viable, we’ll delve into various app types and features, providing you with a better understanding of what to consider when building an investment platform. Let’s get started!

The Essence of Investment Apps

Speaking frankly, accessing your financial portfolio from anywhere and even on the go via your mobile device is really attractive. And that’s exactly what investment applications are made for.

Basically, an investment app is a mobile service that enables users to invest in and manage their funds across diverse financial markets. It can be stocks, bonds, mutual funds, as well as cryptocurrencies.

In particular, online investing apps provide individuals with a variety of tools to monitor portfolios in real-time, make informed decisions about transactions, access research and educational resources, and much more.

Choosing a Winning App Development Strategy

Watch our webinar to uncover effective mobile development approaches and launch your app.

Types of Investment Applications

To develop an exceptional investment app, you need to know what types are available on the market today. Let’s skim through the most popular ones.

1. Banking

These apps offer a convenient all-in-one solution by integrating both banking and investing functionalities. They aim to meet diverse user needs, such as making transfers between accounts, paying bills, depositing checks, and trading stocks.

Some banking applications offer integration with third-party tools. They include lending software, investment platforms, and personal finance management applications. However, such banking apps can scarcely attract avid traders that often look for more specific solutions.

Read on how to Develop an Exceptional Mobile Banking App

2. Robo-Advisors

Robo-advisor apps harness the power of AI algorithms to provide users with needed data. Thanks to this approach, they can offer personalized recommendations to each user for making informed investment decisions.

These apps also incorporate market trend forecasts to discover potential buying opportunities. It particularly makes robo-advisor apps an excellent choice for beginners who may benefit from the guidance and support provided by advanced algorithms.

Check how AI Shapes the Finance Industry

3. Do It Yourself

In contrast to the previous, Do-It-Yourself (DIY) apps, as the name suggests, require individual decision-making. They typically do not include analytics and advice on investment strategies, so they are more suitable for advanced traders.

DIY applications primarily focus on providing investors with essential information such as stock prices and minimum purchase amounts.

Find out more about the Development of a Platform for Self-Directed Investors

4. Hybrid

This one has revolutionized the world of investing by combining the best of both DIY and robo-advisor approaches. Hybrid apps represent versatile solutions that cater to a wide range of investors.

As a result, they become quite appealing both for new and seasoned traders. For beginners, they offer a user-friendly interface and educational resources that help them understand the basics of investing.

As for professional investors, hybrid apps offer advanced tools and features to conduct in-depth research, analysis, and customization according to specific investment strategies.

5. Exchange Platforms

The development of these remarkable financial investment apps has empowered users to explore and engage in a wide range of financial markets, including currency and cryptocurrency, securities, commodities, and the like.

It is simple to leverage mobile exchange platforms to trade and invest in various stocks taking advantage of fluctuations in exchange rates.

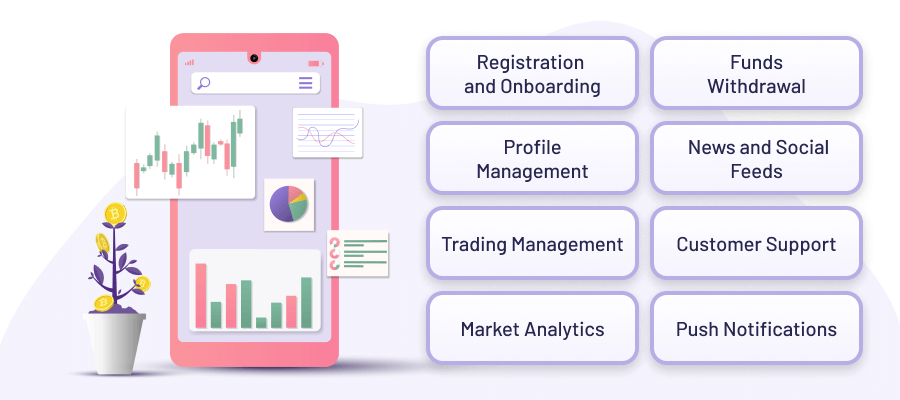

Important Features of Investment Apps

We have discussed the main types of investment applications, so now we can move on to their features. In this section, we will explore essential elements that every high-quality product should possess.

Registration and Onboarding

The first thing you want your app users to do is to sign up. For example, you can offer registration via email address, phone number, social media, or simply via a username. The more options you’ll provide them with, the easier and faster they will start with your app.

To avoid login and security issues, it will be good to use biometric authentication like face ID, fingerprint, etc. In addition, it is worth adding two-factor authentication for enhanced security and better user data protection.

Onboarding is another important thing to keep in mind in the registration stage. By providing a comprehensive guide about your product and its overall features, you enable users to understand the benefits it offers. Furthermore, onboarding assists them in navigating through the application more effectively and leads to a better user experience.

Learn how we built Onboarding Software for a HealthTech Company

Personal Profile

As you can guess, the personal profile is an essential component that helps users manage their personal data. Here, they can fill out details like name, age, trading experience, financial goals, etc.

These insights help the app understand the user’s investment preferences and provide relevant options and recommendations aligned with the user’s objectives.

Trading Management

Obviously, the trading management feature is the most essential for your app. Without it users won’t be able to make any deals at all. So make sure to implement efficient tools to allow investors to buy and sell orders, monitor stocks, and generally manage their finances. This functionality should also enable tracking transaction history and reviewing account balances.

To enhance trading management within your investment app, it is worth integrating it with payment services for seamless online transactions. When done effectively, it has the potential to increase user retention for your products.

Read the case study about the Implementation of the Intelligent Trading Platform

Market Analytics

Market analytics is another essential feature that is valuable for investors. It provides users with insightful data and tools to make informed financial decisions. In particular, clients can gain access to real-time market data and charts. They can assess performance indicators and track stocks, analyze trends, outline potential risks, etc.

On top of that, market analytics offers insights on portfolio and personal recommendations based on market trends and customer goals.

Funds Withdrawal

This feature allows users to withdraw their invested funds from the app when they need to access their money. It provides users with flexibility and control over their investments.

Withdrawing funds ensures that traders can easily convert their investments into cash when needed. With it, they can adjust their investment portfolio, reallocate funds, or withdraw profits without any unnecessary delays or restrictions.

News and Social Feeds

These two can noticeably ramp up users’ engagement with your app. By integrating market news within your app, you offer up-to-date information and insights about the financial markets. The social feed, in its turn, encompasses comments and allows traders to discuss common challenges.

In short, these features can foster a sense of community and enhance the overall investment experience.

Customer Support

“Customers don’t expect you to be perfect. They DO expect you to fix things when they go wrong.”

— Donald Porter, former Vice President of British Airways

Stitch in time saves nine. That’s why you need to think in advance of customer support that can definitely improve user comfort and satisfaction with your application. For example, you can consider implementing live chats, a callback option, or direct contact with the support team. It will help investors easily take the right actions in case of any questions or issues.

Push Notifications

The last feature in our list is push notifications. This handy tool plays a crucial role in keeping users well-informed about various trading aspects, such as market news, emerging trends, and prices.

Notifications can also provide insightful data on the investment portfolios, helping maximize profits. Or alert traders about stop-loss and take-profit orders. Additionally, you can use push notifications to announce essential app updates and new feature releases.

Proven Steps to Build an Outstanding Investment App

Having discussed the main types and important features of investment applications, we can move on to their building process. Here are the key steps to consider if you want to create a doozy app.

1. Set Goals and Conduct Market Research

To ensure the success of your software, it is essential to establish clear goals and conduct deep industry research. It will allow you to identify and analyze your competitors, understand market gaps, and seize opportunities to fill them. As a result, you can develop a clear vision for your product.

Overall, these insights will help you better understand customer pain points and needs, thus making it possible to differentiate your product and gain a competitive edge.

2. Choose a Monetization Strategy

It’s important to outline how you are going to monetize your app. There are many monetization strategies for investment apps that you can choose from according to your needs. For instance, it is possible to charge clients for access to your software or implement fees for managing deposits or executing transactions, like Robinhood and Coinbase do.

Alternatively, you can opt to keep your application free by integrating in-app ads. Though it sounds quite appealing, this method should be implemented carefully, as in-app advertisements may be overwhelming and drive users away from your solution.

3. Select the Platform

The next step to develop an investment app is choosing the platform. There are three common options to consider — iOS investment apps, Android applications, or cross-platform solutions. The latter allow for creating apps that can run on multiple operating systems, which make them more cost-effective in some cases.

Before making a final decision on what platform to go for, consider your target audience, budget, and required functionalities for your app.

4. Make a List of Features

We talked about many features to take into account when building an investment application. Depending on the type of your app and goals, you can implement all of them or focus on a few. Anyway, there’s always an option to start with MVP development to validate your idea and collect feedback from first users.

MVPs are perfect if you’re on a low budget or uncertain about what functionality to begin with. Once your product shows potential, you can go on, add features, and develop a full-fledged investment app.

Find out How to Prioritize Features for Your MVP

5. Elaborate UI/UX Design

First impressions truly matter. So whatever outstanding products you create, you cannot go far without user-friendly design. Its thorough development will add greatly to your mobile app, make it easy to navigate, and improve user engagement.

UI/UX design is also important for keeping your app responsive across different screen sizes and orientations, thus making it possible for users to leverage it on various devices.

Watch our webinar to discover How to Design a User-Driven Product

6. Consider Integration

In order to improve user experience, optimize trading operations, and provide robust features and services, it may be necessary to explore integration options for your app with third-party solutions.

For example, you can ensure the connection of your app with financial data providers through their APIs. It will allow the application to access real-time market data, stock prices, financial news, and other relevant information. As a result, users can stay up to date with market trends and make informed investment decisions.

Moreover, API integration not only enables investors to execute trades directly within the app but also helps prevent unauthorized access and safeguard sensitive financial information.

7. Follow Regulatory Compliance

In financial app development, regulatory compliance plays a vital role. First of all, when creating an investment app, you need to be registered as a broker-dealer, but you probably know that.

Next, following relevant regulations and guidelines, such as Financial Industry Regulatory Authority (FINRA) Rules or Anti-Money Laundering (AML) regulations, will help you ensure the app operates within the legal framework.

FINRA sets rules and standards for brokerage firms and investment professionals. As for AML regulations, they require verifying the identity of customers and implementing measures to prevent money laundering and terrorist financing.

These are just a few examples. Of course, there are more regulations to adhere to when developing investment software. So it is worth being aware of them and following the relevant ones for your product.

8. Keep Your App Secure

The last but not the least important step is keeping your application secure. Investment apps should employ robust security measures to safeguard personal and financial information from potential data breaches.

In addition to following best coding practices, implementing end-to-end encryption, and conducting regular security audits, there are some fundamental steps to consider:

- Two-factor authentication. By implementing two-factor authentication, you can add an extra layer of security to your app. In this case, users will be required to provide additional verification beyond their passwords.

- Secure networks. To reduce the risk of unauthorized access and data interception, encourage your users to avoid connecting to public Wi-Fi networks when accessing investment apps.

- Privacy policies. Provide a comprehensive privacy policy on how your app will collect, use, and share personal data within the app and its associated entities.

- Account protection. Asking users to create strong and unique passwords will help prevent unauthorized access and enhance overall account security.

Examples of Powerful Investment Apps to Get Inspired

Before wrapping up, we suggest going through some most popular investment apps available in the market today. It’s always good to know successful examples to get inspired.

Robinhood

This is one of the most popular investment apps. Robinhood is well known due to its commission-free trading. That is one of the reasons why it is so appealing. On top of that, it offers real-time market data, allowing users to buy and sell stocks, ETEs (exchange-traded funds), or cryptocurrencies. This makes it a good app both for new and advanced traders.

Binance

This one is rated by Forbes as one of the best investment platforms for cryptocurrencies. Binance offers access to a wide range of cryptos, including popular ones like Bitcoin and Ethereum, as well as numerous lesser-known altcoins․

To enhance the user experience, Binance has developed its native cryptocurrency called Binance Coin. It can be used for discounted trading fees, participating in token sales, and various other purposes within the Binance ecosystem.

Discover how we help build the First Crypto-Mining Browser

Betterment

It is a popular robo-advisor app that provides automated investment management services. With Betterment, users can benefit from features like tax-loss harvesting, which helps minimize tax liabilities by strategically selling investments at a loss to offset gains.

One of the key advantages of Betterment is its user-friendly interface. The platform provides a streamlined and straightforward experience that allows customers to easily set up and manage their investment accounts.

Start Your Investment App Journey Today

The temptation to embark on the journey of investment app development can be too high to ignore. However, building an outstanding investment solution is a challenging endeavor.

We have explored the key features to include in your solution and the steps that will guide you on your path to success. If you want to start investment app development and need help with it, we can assist you with getting a piece of the pie in this highly competitive market.

Our team of professionals will help you find the right approach for your specific needs and deliver a secure and efficient application. Don’t hesitate to reach out to us.