No matter the industry you work in, it’s likely you’ve heard a lot of talk about the need for investing in digital transformation.

This is especially evident in the insurance sector. In fact, automation, in particular, could save the insurance industry between $5-7 billion. Not surprising, considering some insurers have already seen a 25% expense ratio reduction from overhauling legacy systems and integrating new software.

The race towards truly embracing IT innovation has begun. For many insurers it starts with rethinking their existing processes and turning to insurance policy management software.

Manual and repetitive tasks surround insurance operations. Underwriting, quoting, cancellations, and even fraud detection — all typically require human assessment. This results in tedious, non-inspiring work for employees and higher risks of error.

As we have mentioned above, early adopters have started with insurance policy administration software and if you don’t want to fall behind — it’s something you should consider too.

In this article, we will discuss what policy management involves, how it can be enhanced by innovative solutions, and what are the must-have features you should look for when choosing this kind of software.

Why Should the Typical Insurance Policy Administration Process be Automated?

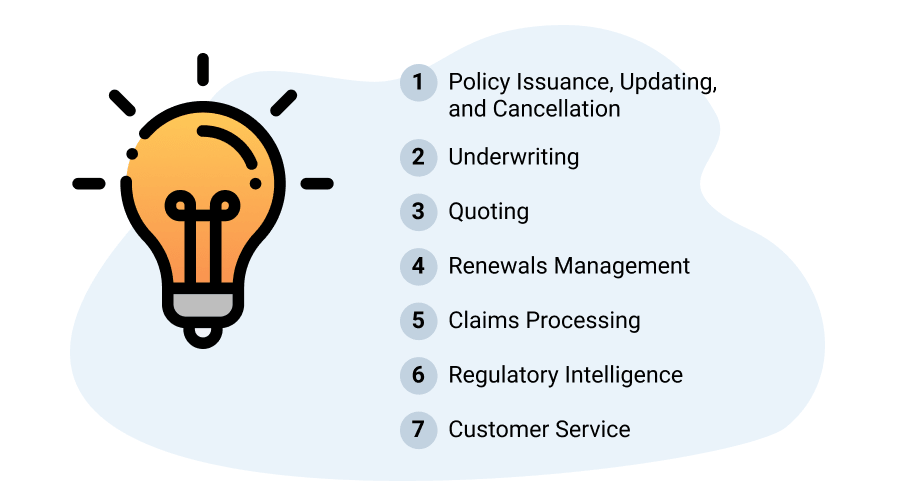

Policy management is the end-to-end process of handling insurance services. There’s a multitude of tasks that insurers need to handle as part of it, including:

- Underwriting

- Quoting

- Proposal generation

- Policy issuance, renewal, and cancellation

- Claims processing

- Loss run report preparation

- Compliance checking

As you can see, policy administration encompasses all the main business processes of an insurance firm. By automating these tasks your company can differentiate and become more cost-efficient while delivering better service. Isn’t that something every company wants?

How Does Policy Administration Software Upscale Insurance Business Performance?

Some organizations might still be leaning on manual processes and physical folders for all of the workflow. Others may have already started their digital transformation efforts and are familiar with CRMs and paperless document management. However, you should measure yourself by the frontrunners.

To stay ahead of the curve you should look at early adopters and discover how they apply insurance policy management software. The most tech-savvy companies are focusing on AI and machine learning. Moreover, they are leveraging robotic process automation, predictive analytics, and other emerging technologies. All to speed up and simplify internal processes.

“Today, insurance organizations that apply AI throughout the value chain will find strategic advantage through 2025. However, long-term AI will be a critical success factor and reach mass adoption by 2030.”

— Kimberly Harris-Ferrante, Distinguished VP Analyst Gartner

Source: Gartner

Of course, if you’re just starting out with process automation and IT solution development, you may not be familiar with the potential the technology can bring you. The reality is, all insurance companies will see a boost in business performance from embracing innovation.

As an example, life insurance policy administration systems can upscale the process of managing new life, annuity, pension, and health insurance products. Yet, this is just one example of policy management improvement.

Frequently, companies notice a significant advance in flexibility and ease of administration. Hence, there’s no need to hold on to old ways of managing policy when you can leverage emerging technologies and boost your performance today.

Keep reading to discover the must-have attributes and learn how innovative tools can help you advance your business.

Must-Have Features of Insurance Policy Management Software

Intelligent insurance policy management software should simplify your life. It’s as plain as that. It needs to make your work easier and reduce the amount of time you spend on repetitive tasks that drive little value. So, let’s take a look at the components of the most useful policy administration software.

1. Policy Issuance, Updating, and Cancellation

The first must-have of any insurance policy management software is the ability to systemize everything to do with policy. With its help, you will be able to generate all kinds of necessary documents. Plus, maintain a record for all related information and manage the entire lifecycle.

When you make changes to documents, the updates have to apply everywhere in your internal systems. If everything is synced, there’s no need to refresh information repetitively. On top of that, with modern technology like Robotic Process Automation (RPA), these tasks no longer have to require a lot of manual work.

An insurance policy administration system with RPA tools can extract change requests from emails, call transcripts, web forms, or other sources and sync them. Thus, reducing processing time for policy issuance, updating, and cancellation.

Sounds overwhelmingly complex? It doesn’t have to be. Nowadays, some vendors provide low-code platforms with pre-built user interfaces or simple drag-and-drop features.

2. Underwriting

Underwriting can be one of the most time-consuming processes for any insurance company. An underwriter needs to look at the applicant’s credit score and history, loss-run reports, savings amounts, and more to assess the risk thoroughly. Often, all this data is dispersed across different platforms and requires manual processing.

With intelligent automation, you can speed up this process of data gathering and analysis. By virtualizing the underwriting process, insurers can mine data from a range of sources and get access to the information they need, when they need it.

Hence, when you’re hunting for policy management software — check that it has automated underwriting capabilities.

IoT tools, too, can be of utmost interest. By accessing data provided by connected equipment, underwriters can make their decisions based on real-world behavior. Thus, leading to better risk assessment in a shorter period of time.

3. Quoting

Quoting capabilities are a must in insurance policy administration software for forward-thinking companies. Even if you automate all other tasks, you simply can’t do with an inefficient quoting process.

Modern solutions let you provide quote estimates to potential clients without having to interact via a phone or face-to-face. Instead, your leads can fill out the needed information and quickly get an approximation of what they would have to pay.

So, if you’re on the lookout for an all-encompassing policy administration system that will drive innovation in your insurance business — quoting solutions should be part of the deal!

4. Renewals Handling

Keeping track of renewals and avoiding customer churn is another important task for insurance companies. Luckily, policy management solutions can help in this area too.

With renewals management features, carriers can notify policyholders of the impending coverage end date and allow them to renew the policy in a timely manner.

When done properly, customers face a smooth and stress-free process. They simply update the needed fields as the majority of the information is already fetched and synced within internal systems.

5. Claims Processing

Claims management is one of the core processes in any insurance sector which is why automating its workflow should be a logical priority.

Software that incorporates claims processing essentially automates the entire claim settlement process. Custom software solutions, in particular, allow for advanced development options that cater to the insurer’s unique workflows.

With automation, claims can be quickly assigned, fraud evaluated, payments issued, and reports generated. All thanks to automated data exchange between systems which significantly reduce manual labor.

6. Regulatory Intelligence

Insurance companies have to comply with an extensive amount of country and state-specific regulations. At times, changes to these laws force insurers to reorganize processes to avoid breaches and hence the financial loss.

Regulation intelligence is a large part of dealing with policy. Thus, it’s not surprising that some insurers may want to get a solution that considers regulations in policy processing.

Modern technologies can now provide a comprehensive set of tools to manage all regulation-related tasks. From workflow management, reporting, and audit trails to extensive intelligence features that help track changes.

7. Customer Service

It’s no secret that immaculate customer service lies at the core of any long-term business success. In a stress-filled sphere like insurance, this is especially true.

Your policy management processes have a direct impact on customer service. A lot depends on the speed of your communication. Take too long to reply and the lead might leave. Give inaccurate information and the client may end up churning.

Automation across all the previous areas we’ve discussed will enhance your customer service as a whole. However, some solutions can come with CRM and marketing automation features. These make it easier for you to interact with clients. This is especially true of custom developed software, as it can include only the features that you require.

Learn about Custom CRM Software Development Services

Advantages of Insurance Policy Management Software

Now that you know the main features to look out for in policy solutions, let’s talk about the benefits you will see as a result of investing in this kind of software.

Improved Efficiency

As a result of automating the majority of policy management tasks, your insurance business will become a lot more efficient. Instead of dealing with paper, you will transition to electronic documents that let you organize data in the best way. In the end, your employees and customers will be grateful.

Enhanced Customer Service

With policy management software expanding to mobile devices, you will be able to provide customers with timely responses, thus contributing to increased satisfaction. Moreover, with features that speed up quoting and claims processes, your leads and clients will be less likely to turn to competitors. Definitely, something that will reflect nicely on your bottom line.

Automated Regulatory Compliance

Improved compliance monitoring will help minimize breaches that are likely to incur financial costs. Not to mention, your team members will no longer need to spend valuable time monitoring regulation changes. Instead, everything will be inside one, convenient software.

Reduced Costs

All of the previous benefits, one way or another, lead to reduced costs. You will become more cost-effective thanks to employees focusing on more strategic tasks as opposed to routine work. Better customer service will lead to lower costs associated with client attraction. Automated regulatory compliance will help reduce financial risks that can come from breaches.

As a whole, policy management software is a cost reduction powerhouse that innovative insurance companies should embrace.

Ready for Custom Insurance Policy Management System Development?

Hopefully, you now feel familiar with the benefits an insurance policy management system can bring. Yet, a logical next question would be whether to turn to a custom or a canned solution. The short answer is — it depends.

The Insurance sector might not be the quickest one to jump on the digital transformation bandwagon, but that doesn’t mean you can afford to postpone investing in IT any longer. Policy handling is one of the core processes in insurance companies and embracing automation in it can be completely game-changing.

At Velvetech, we understand that taking on a full IT system upgrade can be an overwhelming endeavor. With custom insurance software development, however, you don’t have to rush and can take everything at a pace that suits your company. Hence, if you’d like to talk to our experts about developing insurance policy management software for your business — don’t hesitate to reach out via the form below.