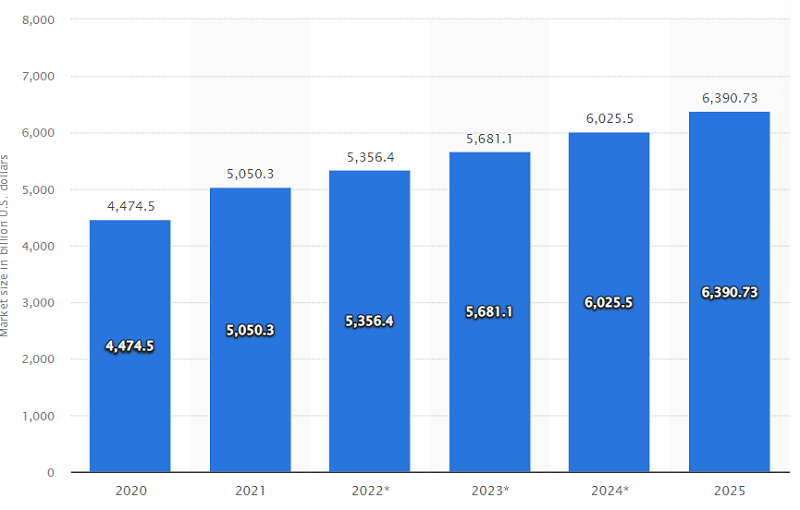

After a year like 2020, consumers are more concerned than ever of protecting their assets, health, and the future of loved ones. In fact, the global insurance market is projected to reach $6.9 trillion by 2023 and is likely to keep on growing from there.

Moreover, specifically in the U.S., firms have noticed that there was a double-digit increase in the number of life insurance policies sold during the pandemic in comparison to the year before. Thus, illustrating the boost in demand for health-related assurances.

As you can see, consumer interest is growing, so companies have to keep up and leverage every sales opportunity, provide premium estimates quickly, and do all that without incurring enormous new costs. The good news is — modern technology can help.

Today, we’d like to dive into the subject of insurance quoting software and help you understand why these solutions can be game-changing for a business.

How Can Quoting Software Help Insurers

Historically, consumers did prefer to get their insurance through in-person channels. However, by 2020, the majority have shifted their preference to other distribution methods like phone, mail, and online. Thus, it’s imperative for insurers to cater to these changing needs.

That’s where insurance quoting tools can come in. Instead of forcing your potential clients to wait and submit a ton of personal data before informing them of the prices, you can leverage online quoting software and automate the whole process.

In essence, this type of software lets you gather the basic information from your leads and quickly provide them with cost approximations. That way, instead of having to call or come in for a face-to-face meeting, potential clients can get an idea of the amount they’d have to pay via online channels.

As you can imagine, besides significantly improving customer service, an insurance quoting system will boost your lead generation efforts and even reduce operational costs. Sometimes, it can also come as part of policy management software, resulting in excellent workflow automation and a lot of potential for scalability.

Key Features of Insurance Quoting Software

We’ve established that quoting software exists to provide pricing approximations to potential clients and to reduce the workload of an agent or a broker. However, in order to truly benefit from this technology, you’ve got to know the four main features that it should have.

Quote Calculation

Naturally, insurance quoting software needs to have quote calculation capabilities. Usually, this is represented in the form of a tool that allows leads to fill in their financial information like mortgage or debt existence. In the case of life and health quotations, there’ll likely also be fields related to health and medical history.

With the help of a calculator, your customers will get insights on the different types of coverage that is available to them. On the other hand, your insurance business will minimize manual calculations and time spent on communicating with leads.

Chat

Next, for smooth customer service, a chat should also be available when leads are trying to get their quote estimates. Some fields may spark confusion in consumers and they may be unsure of where to find certain personal information. Hence, it’s always good to have someone on standby to answer questions and point customers in the right direction.

CRM Integration

Large insurance companies place a big emphasis on the efficient management of customer relationships and rely heavily on the work of their sales agents. So, if insurance quoting software integrates well with your CRM, you’ll be able to facilitate data storage, customer information updates, and improve sales and marketing communications.

Discover 5 Ways a Process-Driven CRM Improves Your Lead Generation

If you don’t yet have an effective CRM — it’s not a problem. These solutions don’t have to be complex or take up too much of your time to set up. In fact, you can turn to a low-code CRM that will help you improve productivity and get more leads without needing to learn coding.

Comparison Module

Finally, a comparison module might be especially needed in insurance agency quoting software. Since agents and brokers work as intermediaries, they may need to provide quotes for multiple carriers and be able to illustrate the differences between offers.

So, by getting a solution with comparison features, insurers will allow customers to evaluate quotes from various providers all in one place.

Benefits of Insurance Quoting Software

Now that you know the main features of online quoting software for insurance firms, it’s time to go over the key advantages of such technology.

Improved Lead Generation

One of the primary benefits of insurance quoting software is that it helps agents with the lead generation process. How? By catering to the needs of potential customers.

Consumers want to quickly find the information they seek without going through a lengthy process and providing too many personal details. So, if you don’t offer the chance to get insights about their possible premiums — they’ll just go to another provider who will.

Moreover, quoting solutions add a new opportunity to build a relationship with prospects and impress them with your thoughtful services. For instance, in order to obtain their quotes, leads will input some basic details about themselves and contact information. Then, even if they don’t immediately request a thorough estimate, you can add them to your CRM and start the nurturing process.

Better Customer Service

Improved customer experience is a natural byproduct of developing insurance quoting software. By turning to technology, you’ll eliminate needless paperwork for yourself and your customers. Moreover, since face-to-face contact will no longer be necessary, your leads will be able to get the information they seek quickly and be left with a positive impression of your services.

Finally, if you ensure that all of the above features are implemented or tailor your solution through custom software development, you’ll have an all-encompassing tool that provides a smooth experience. It will guide the consumer seamlessly from being a prospect, to a lead, and in the end, a loyal customer.

Find out what are The 9 Key Benefits of Custom Software Development

Reduced Operational Costs

The third benefit of quoting software for insurance companies is definitely the reduction in costs. By automating the majority of the processes associated with calculating quote estimates and sharing them with prospects, you’ll be able to free up the time of your personnel.

Instead of performing manual calculations and setting up face-to-face meetings, your agents will be able to focus on delivering a top-notch experience to your customers and bringing in more and more revenue.

Learn how Velvetech Turned Insurance Company’s Sales Team Into Rainmakers

Top Use Cases of Digital Insurance Quoting Software

In 2021, health and life insurances dominated the U.S. market with their size estimates being $1.1 trillion and $886.7 billion, respectively. These are the two largest sectors we’ll focus on below. However, the quotation software can benefit other insurers as well.

Health Insurance

As we’ve already mentioned a couple of times, health insurance is one of the most popular sectors where quoting software can be used. Many top U.S. insurance companies like Cigna or Anthem that operate on the health market leverage such software and provide their clients with a quick access to helpful data.

In general, the insurance quoting solutions can be divided into two categories — the first helps obtain an individual health insurance policy and the second serves to insure a group of people.

As the names suggest, they help prepare and automate quotes for individuals or a group of people depending on the request. Of course, quite often, the software can combine both types at once.

Read about Data Automation for a Top Dental Insurance Consultant

Life Insurance

Life insurers face increasing demand as more people decide to address the need for mortality protection. Apparently, this is the reason why insurance quoting tools are essential for any company providing services in this field.

For example, a quoting tool helps insurance brokers fulfill the growing number of customer requests for services. This is achieved by improving every aspect of their experience and facilitating the entire process.

Home & Auto Insurance

Another popular use case for quoting software lies in the auto and home insurance domain. Here, the software helps easily and accurately calculate actual premiums and supports future policyholders with a convenient tool to streamline their customer journey.

Commercial Insurance

Commercial insurance is undoubtedly a huge sector that can benefit from the right tech solutions for customers. From a reputation and financial state of a business entity to the wellbeing of employees — commercial coverage protects various lines of business assets or even obligations.

Embracing quote software for commercial insurance helps carriers, agents, and brokers come up with structured plans to cater to the client business industry and specific field of operation.

Getting Started With Quoting Software for Insurance

Whether you’re in insurance agency management or are a carrier looking to improve the lead generation process — insurance quoting software is worth your attention. It not only provides automation and cost reduction benefits to your company, but also serves to improve the experience of your customers.

If you are interested in developing an insurance tech solution for your business — we’d be happy to help. Our team provides extensive insurance software development services and can build a solution that caters to your unique needs. We do more than just support you with software, we guide you through the entire process and take a personalized approach with each client.

So, don’t hesitate to reach out and let us know which challenges your business might be facing!