Today, when we can have our smart appliances get our breakfast done while we are going through our morning routine, when we can measure a heart rate or conduct an ECG with a smartwatch — everyone seems to have high expectations for services that companies offer. Of course, the insurance business is no exception.

It’s only natural that companies from this sector are trying to manage customers’ expectations by taking their businesses online. Some of the front runners add a mobile app as another outlet for their services.

In the meantime, startups working on blockchain-based insurance solutions pop up here and there. All this creates a great insurance software development momentum, with companies like Velvetech taking the lead in creating apps and customizing products to overcome technical problems and constraints in this industry.

Building insurance solutions that tap into the potential of new technologies, e.g. AI, IoT, and Blockchain, is by no means an easy task.

Insurance companies face a lot of challenges in pushing forward their software development initiatives. Let’s take a look at some of the issues businesses need to address to meet the ever-rising customers’ demands.

User-Driven Approach

Watch our webinar and learn the top ways of reducing poor user satisfaction, low adoption rates, and decreased loyalty.

Benefits of Insurance Software in Action

The days when the everyday routine of the insurance agent was filled with processing a huge amount of paperwork are still fresh in mind. Working on a single case would oftentimes entail lots of calculations and multiple indexes lookup.

Insurance solutions, backed by modern technologies, can help companies get rid of labor-intensive routines by replacing outdated software systems. Share on XAgents and brokers would work on these and other related tasks manually, getting little, if any, help from the legacy software with limited functionality.

Deployment of employee- and customer-facing applications may significantly empower any insurance business, opening up new opportunities for growth. To be precise, leveraging InsurTech solutions can offer the following advantages:

- Optimized automatic workflows: better risk balance, less manual work, and faster staff operation

- Elevated customer experience

- Improved services accessibility

- Advanced data manipulations to generate insights into customer behavior and business performance

- Increased ROI

Insurance solutions, backed by modern technologies, can help companies get rid of labor-intensive routines by replacing outdated software systems. Such modern systems focused on automation and enhanced UI and UX can certainly offer a more streamlined personal experience to customers and partners.

Learn about the Difference between UI and UX Design

At present, the market provides insurers with a tremendous opportunity to introduce new bold technological solutions and reap higher profits.

Project Health Check

Learn the actionable steps to keep your software project on the right track, aligned with your initial goals and designated priorities.

Top 5 Challenges of Insurance Software to Keep in Mind

InsurTech, the industry’s big move to blend insurance with technology, appearing startups, and growing customers’ expectations — all drive the insurance sector that’s been stagnant for years.

Regardless of whether a company attempts to develop or update its app with an in-house team or outsource this to professionals, there are inevitable challenges both will need to respond to.

Undoubtedly, building a successful product takes a lot of effort. Here are a few focal points that InsurTech organizations should pay attention to when working on creating the next big thing for the marketplace.

1. Customer Experience Comes First

It’s important to remember that customers want as little interference between them and the insurance software product as possible. Therefore, investing in a thought-out, user-friendly app interface while simplifying business logic definitely pays back.

Customers will appreciate a clean layout and intuitive navigation. And a satisfied customer will definitely bring friends and colleagues, more so when offered a tempting bonus in return.

2. Omnichannel Distribution

Developing mobile and web insurance solutions ensures a seamless cross-platform experience for customers. iOS and Android apps can offer unparalleled onboarding experience and serve as an extension to a web portal.

While an online insurance product is likely to become the cornerstone for innovations and will attract more users compared to a single mobile app, making the site mobile-friendly helps to establish a larger user base.

3. Data Security

Dealing with personal customer data is a sensitive matter. So cybersecurity is essential for any insurance product. Fortunately, industry regulators guard this aspect pretty well. Companies need to ensure full compliance of their software with the DOL Fiduciary Rule, Dodd-Frank Act, etc.

Front-runners also take advantage of the blockchain technology and AI algorithms to enhance the security of their insurance products and fight fraud. On the user front, such technologies as biometric authentication and two-step verification come very handy.

4. Uptime Reliability

Cloud-based insurance platforms allow for lowering the cost of setup and maintenance of software. 24/7 customer support is a must in the insurance industry and, thus, picking the right infrastructure for the app back-end, e.g. Amazon Web Services or Microsoft Azure, is highly important.

The damage to reputation in case of emergency, when the system is down, and an alternative is so easy to find, can hardly be overestimated.

5. Big Data Insights

Big data is becoming more and more prominent in insurance software solutions as new technologies like IoT and ML enable businesses with more ways to gather and analyze customer data.

Data analytics equipped with these tools add value to the fundamental insurance workflows:

- Risk management

- Fraud prevention

- Personalization of services

- Investment portfolio management

Insurance Solutions Must-Have Features

Insurance software functionality will obviously depend on its target audience: whether an app has been developed for the internal use or for customers and partners.

Consumer-focused applications should include some of the following features to become customers’ go-to source for insurance services:

- Web-based real-time quoting

- Claims completion and submission

- Customer profile and inventory

- Payments

- Live chat or video support

- Miscellaneous: handwritten input, documents scanning, file storage, location-based services.

Insurance solutions developed for the internal use by company’s employees and its partners often focus around such functionality as:

- Policy management

- Analytics platforms

- Fraud prevention

- Underwriting automation

- Documents lifecycle automation

- Claims management

Use Cases of Insurance Software

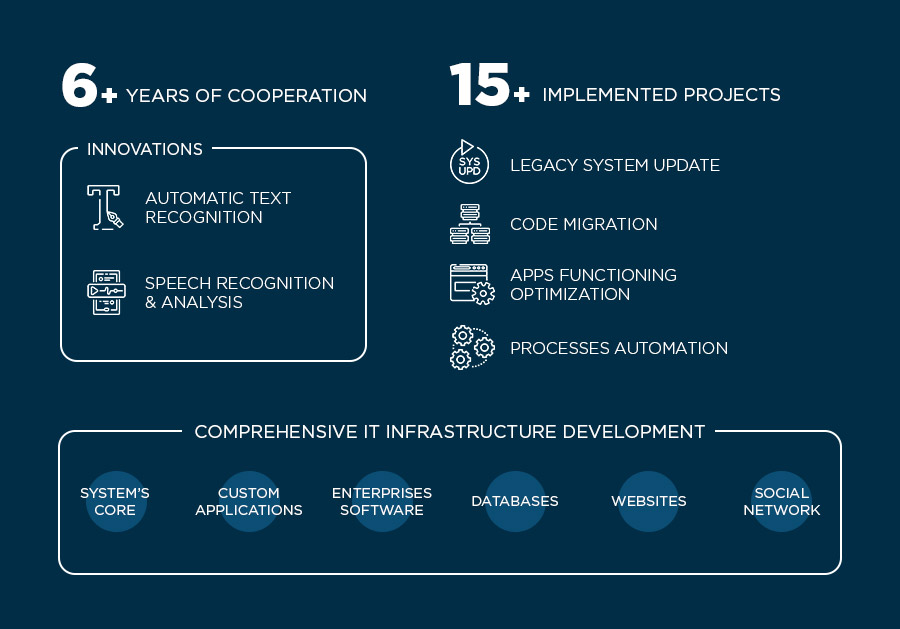

Velvetech has worked on multiple InsurTech projects. One of the brightest examples is our over 6-year collaboration with an insurance trailblazer, Insureon.

Here’s a quick list of tasks that we successfully realized for them:

- Update of a legacy core insurance system to support microservices

- Integration of marketing & sales automation platform

- Adding a form builder for collecting customer data

- Building a monitoring system for controlling the company’s core system performance

- Customization of a third-party OCR solution for automatic texts recognition

- Creating a speech recognition and analysis module integrated with the company’s call center

Meet Insurance Software Challenges with Velvetech

As you can see, there are multiple details to consider in the insurance software development domain. Therefore, you should tread lightly relying on a professional team with a proven track record of successfully completed projects.

Give us a shout if you have issues with your insurance software or need to update it. We can also help you develop an entirely new solution or address any challenges you may face while building an app.