With the number of mobile devices in the world growing, it is clear that people want to access a lot of things on the go, banking apps included.

In fact, over the past decades, the U.S. mobile banking penetration has been on the rise. The market for these solutions is expected to be at $23.33 billion by 2032. Thus, it’s more important than ever to pursue mobile banking app development that prioritizes features consumers value.

So, in today’s post, we will discuss how to create a mobile banking application, what makes a great one, and some of the typical development challenges you may face. Let’s dive in.

- Mobile Banking App Must-Have Features

- Not-to-Miss Advantages of Banking Apps

- Banking App Development Challenges

- How to Create a Secure Banking App

- How Much a Mobile Banking App Costs

- Trends of Mobile Application Development for Banking

Mobile Banking App Must-Have Features

Chances are, every financial organization wants to develop an online banking application that the end users love, thus differentiating from the competition and increasing customer retention. Even with a constrained budget, it’s not advisable to sacrifice quality.

Find out how to Build a High-Quality App with Limited Budget

Therefore, to avoid wasting time and money, we’d like to share some must-have features you’ve got to implement during development. Let’s take a closer look at each one.

1. Bank Account Management

Naturally, the primary thing your mobile banking software must allow users to do is manage their accounts. Thus, it should provide the ability to monitor debit and credit cards, check balances, view transaction history, and seamlessly transfer funds between accounts.

You can also take it a step further and offer a “savings goal” feature and even automate the transfer of small amounts into consumer savings accounts to help reach their objectives.

2. Payments and Transactions

Next up, you’ve got to ensure your mobile banking app features include secure and seamless transactions. Your customers should be able to easily transfer money to friends and family via peer-to-peer payments, scan QR codes to complete purchases, deposit checks by taking a photo, or exchange currency without having to go to a branch office.

You may go a step further and integrate real-time payment systems to ensure instant transactions.

Additionally, if you’ve already embraced blockchain technologies, your mobile banking solution should also incorporate this innovation. For example, by allowing users to store and manage cryptocurrencies so that payments can be sent around the world securely and with lower associated costs.

To double the security and efficiency of cryptocurrency transactions, it’s worth integrating a crypto wallet into your app. Plus, it enables customers to seamlessly buy, sell, and store their digital assets.

After all, with the forecasting of the global crypto wallet market to reach $77.21 billion by 2032, this advanced feature undoubtedly will be a valuable addition to your product.

Discover 5 Ways Blockchain is Revolutionizing Banking

3. Authentication

Whenever sensitive data is in play, customers want and expect a high level of security. Thus, their banking details should be well protected. To do that, consider implementing authentication features that can be quick while also making the users feel safe.

For instance, you can let your customers opt in to multi-factor authentication. It can be time-consuming, but if it’s a choice left up to them — it could work. Or, implement biometric authentication technology, which quickly verifies the person via physical characteristics like fingerprints, voice, or facial features.

4. Customer Support

Providing 24/7 customer support to your clients is a must in the modern world. After all, people may be across different time zones and would need any issues to be resolved quickly. Besides round-the-clock contact centers and chat features, you may want to improve the user experience even further.

Discover how Velvetech Helped a Finance Firm Improve Customer Service

So, consider adding intelligent chatbots to your mobile banking application development to-do list. They can easily answer simple inquiries, thus saving time for your managers while providing excellent customer service with high personalization.

5. ATM and Office Locator

If you want to ease the lives of your customers and have your app remembered as a truly helpful solution, you’ve got to add an ATM and branch office locator capability. It should showcase information on the services provided at nearby locations, opening hours, and even the most optimal routes to get there.

6. Push Notifications

Push notifications are a must for pretty much any kind of mobile app looking to keep customers informed and provide a pleasant user experience. So, make sure your solution can send alerts on account updates, transaction confirmations, and other relevant occurrences.

However, be subtle and avoid too much intrusion with frequent notifications. Ideally, let your users easily locate and set up their preferences within your app. That way, you reduce the likelihood of them getting annoyed while using your tool.

7. Investments

Depending on whether your bank supports investment operations, you should consider adding these capabilities to the mobile application, too. The sky’s the limit, as long as you’re providing functionalities your customers actually use and truly value.

Let your clients manage their stock portfolio, purchase gold and silver, or even exchange cryptocurrencies. Offering robust investment management tools and features within your mobile application can enhance customer experience and empower them to make informed financial decisions.

Learn more about Cryptocurrency Development

8. Personalized Offers

When you set out to build a banking app, personalization should definitely be on your list of priorities. Customers like personally curated experiences and are more willing to engage with them.

In fact, according to Forbes, 81% of consumers find personalized recommendations and offers important. So, to cater to these needs and differentiate from the competition, consider adding personalized offerings like discounts, ticket sales, car booking services, flower deliveries, or restaurant and hotel bookings to your mobile banking app.

9. Integration with Wearables

Today, wearables and other smart devices are becoming more and more popular across the globe. Thus, your mobile banking software should have the ability to integrate with them and deliver a cohesive user experience through alerts, balance checking, and payment capabilities.

Discover the Use Cases of IoT Wearables

10. Connection with Open APIs

Another key feature to include in your app is open banking API integration. This innovation enables seamless data sharing between banks and external apps. Thus, streamlining transactions, expense tracking, payment processing, and various other financial activities.

For example, by connecting your product with PayPal, you can empower customers to make instant, secure, and charge-free transactions. Therefore, significantly enhancing their overall banking experience.

11. Offline Mode

Though internet connection today doesn’t seem to be a problem, there are still cases where people may find themselves without access — yet still need to complete crucial transactions. So, why not give them the ability to use their apps with limited capabilities offline?

Typically, offline mode allows users to access their accounts, check balances, view transactions, or pay bills. You can also offer users the option to schedule transfers that can’t be completed offline but will automatically process once the internet is available.

12. Voice Command

Did you know that the market for voice-controlled fintech solutions is projected to reach $2.99 billion by 2028? So, why not incorporate it into your app?

This feature enables consumers to seamlessly access their banking records, make transactions, and process payments using voice commands. Overall voice commands significantly enhance user engagement leading to a more intuitive banking experience.

Choosing a Winning App Development Strategy

Watch our webinar to uncover effective mobile development approaches and launch your app.

Mobile Banking Apps Benefits for Financial Institutions

Obviously, it’s hard to disagree that a robust banking app is non-negotiable for financial institutions striving to stay competitive. Here are the key advantages that support this statement:

Lower Operational Costs

It’s probably hard to name a banking app that does not offer automated tasks like fund transfers, bill payments, loan applications, and more. This not only makes banking services faster and more efficient but also budget-friendly by reducing human intervention in customer service. Thereby cutting down on staff efforts.

Increased Customer Engagement

Automation not only helps reduce operational costs but also significantly enhances customer engagement and retention. After all, who doesn’t enjoy making payments from the comfort of their home instead of wasting time visiting a bank branch and waiting in long lines?

By offering customers such convenience, financial institutions greatly improve customer satisfaction and loyalty, which are essential factors for business growth and increased revenue opportunities.

Customer Analytics

Last but not least, banking apps provide crucial data analytics to enhance overall services, thereby improving user satisfaction.

In particular, fintech solutions collect essential data and offer valuable insights into active user numbers, session lengths, retention and churn rates, and more. This data enables businesses to take proactive steps to enhance the user experience and improve customer retention.

Explore key tips to Boost Your Mobile App Engagement

Mobile Banking Application Development Challenges

Knowing the core benefits to expect from mobile banking software, let’s now unpack the key challenges you may encounter during the development process.

Regulatory Compliance

First and foremost, your banking app should adhere to all the required government regulations, have all of its licenses in place, and comply with KYC.

Uncover how we helped a HealthTech Startup Improve KYC Procedures

Finance companies have quite a few regulations to follow, depending on where they operate. Some of the most well-known ones are:

- PCI DSS: a set of security standards that ensures cardholder data safety across the globe and must be adhered to by any service provider that handles, processes, stores, or transmits credit card information.

- CCPA: requirements set out by the government to improve the level of personal data protection in the state of California.

- GDPR: guidelines for collecting and processing personal information from individuals within the European Union.

- PSD2: European security requirements for initiating and processing electronic payments and protecting consumers’ financial data.

- SEPA: a set of rules for allowing electronic euro payments in Europe to be carried out faster, safer, and more efficiently.

Of course, depending on where you operate, there might be more or less regulations for your online banking application to adhere to. So, make sure to double-check that with your legal and software development teams.

Security

The majority of consumers still don’t trust the security of their mobile banking app. This creates a challenge for financial institutions looking to build a solution that will actually be used to its highest potential.

So, how can this problem be addressed? To make users feel like their personal information is secure while they use your app, you should consider:

- Adding encryption systems

- Encouraging users to create strong passwords

- Implementing multi-factor authentication

- Setting up your data storage infrastructure with various security measures

- Including inactivity timers for user sessions

All of these safety measures will not only increase the security of your product but also make users trust your solution more. So, don’t be afraid to share with them all of the methods you employ to keep their data and accounts safe.

If you want to take it a step further, you can consider turning to blockchain-based technologies to improve data safety. They are already disrupting healthcare, retail, insurance, and finance industries by reducing risks associated with intermediary participation. So, why not embrace it for your mobile app too?

Explore how we secured a healthcare app with a Blockchain-Based Intrusion Detection System

User-Friendliness

Dealing with finances can be stressful and only made worse by a poor user interface and complicated navigation. Thus, user-friendliness is of utmost importance and is something you shouldn’t compromise on.

Sure, younger generations that are familiar with modern technologies might have no trouble figuring out your mobile banking software design. However, it’s unlikely that your customers are all Millennials and Gen Z. So, make sure that there is clear visibility of elements and intuitive navigation logic throughout all areas of your solution.

User-Driven Approach

Watch our webinar and learn the top ways of reducing poor user satisfaction, low adoption rates, and decreased loyalty.

How to Build a Secure Mobile Banking App

We hope that you now understand which features should be incorporated into your mobile banking software and the challenges you may face during implementation. Overall, to develop a secure and efficient solution, you require a thoughtful app architecture that allows for scalability and seamless user experiences. Now, you’re probably asking how to get there.

Well, there are quite a few key steps that your in-house or outsourced development team will have to take. While the process may vary on an individual basis, the following steps are likely what you’ll have to go through:

1. Strategy Development

It sounds quite obvious, but before developing a mobile banking solution, you should clearly define your strategy and set the right goals. It’s one of the key steps in delivering a mobile product that will drive profits.

Start with researching the market and user needs, analyzing what your competitors offer, and evaluating the costs. The more granular your strategy is, the more tangible results your project will provide.

2. Analysis and Planning

Once you’re done working on a general concept, it’s time to move and plan the development of a mobile solution for your banking services. At this step, you need to ramp up the team of experts that will implement your project.

Whether you choose to leverage your internal resources or turn to a software provider to create a mobile banking solution, your team will analyze the project requirements and come up with a viable project plan to adhere to.

3. UI/UX Design

This stage implies delivering an intuitive, user-friendly, and simple UI/UX design. Your team will roll up their sleeves and create wireframes and prototypes, as well as work on designing all visual elements.

Learn the Difference Between UI and UX Design

The way your app looks and feels is crucial for enticing the target audience and retaining them. After all, you need to build trust and offer unique value to make users stay with your solution.

4. Mobile Banking App Development

Now mobile developers can finally start building a banking app. Depending on your requirements, they will deliver two separate apps for iOS and Android or create one cross-platform solution. Each of the ways will impact the choice of technologies and practices to use.

On top of that, they will implement API integrations as, most likely, your app will include data exchange with other third-party tools and services to provide users with helpful functionality.

5. Testing and Deployment

To make sure your app delivers maximum performance, meets the initial goals, and is secure, you’ll need the help of QA specialists. Once testing is done and all bugs are fixed, the app can be deployed and distributed. Again, depending on your strategy and choice of platform, launching the solution to the app stores can vary.

6. Support and Performance Monitoring

No doubt you want your banking app to be successful and useful. Thus, don’t underestimate the support and maintenance part. Collect your customers’ feedback, increase your app’s performance, and implement new features if needed.

Don’t feel too overwhelmed by this seemingly extensive procedure. If you find skilled talent to expand internal capabilities or turn to an experienced app development company, you’ll glide smoothly through the entire process and solve any issues that may arise during each of the above-mentioned steps.

Read more in our Guide to the Mobile Application Development Process

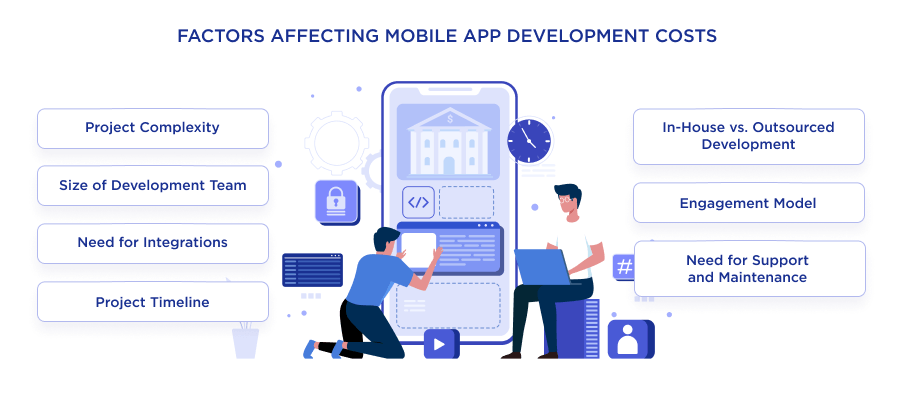

How Much Does It Cost to Develop a Mobile Banking App?

The next natural question we hear you asking is, “How much does mobile banking app development cost?” Unfortunately, it’s hard to give a straight answer.

You see, mobile app development costs are affected by a range of factors, including:

- Project Complexity

- Size of Development Team

- Need for Integrations

- Project Timeline

- In-House vs. Outsourced Development

- Engagement Model

- Need for Support and Maintenance

Hence, even a ballpark estimate is out of the question until you have a rough idea of what your project will entail and what your needs are. We suggest you consider these factors and approach app development experts for a consultation or send an RFQ to get more accurate budget forecasts.

Learn more about How to Communicate Your Idea to the Development Team

Project Estimates

Watch our webinar to learn about the practical ways to evaluate your software project estimates.

Future Trends in Mobile Banking App Development

Now that you know how to build a banking app and the key features to include in your product, it’s important to consider some trends that currently capture the market’s attention. Keeping up with them can help attract more users, better cater to their needs, and stay ahead of the curve in general.

So below, we sum up eight trends in the mobile banking sector for you to take note of:

- Contactless transactions

- ATM connectivity

- Crypto wallets

- Personalization

- Voice commands

- Chatbots

- Biometrics

- Big data to prevent fraud

Getting Started with Banking App Development

Considering the challenges involved in banking application development, it may seem like an arduous and time-consuming endeavor. Truth be told, at times, it can be. However, in the modern, fast-paced world, it is also non-negotiable for financial institutions.

So, if you’d like to enhance your existing app with new, unique features or need to build a banking app from scratch — don’t hesitate to reach out to our team. Velvetech has years of expertise in building mobile solutions that deliver impeccable user experiences and drive continuous business growth. We’d be happy to collaborate with your organization!