When your company has a million turnovers, you can’t afford to treat deals blithely. On the opposite, most likely you’ll follow the “measure twice, cut once” approach before investing a more or less tangible sum of money. Comprehensive analysis, risk assessment, and trends forecasting — hard facts, but in no case gut feelings will be of great help here.

Real estate companies operate huge volumes of data, which makes them those privileged ones that can have exhaustive information about the properties they are going to make deals with. On this basis, the flow of decision-making is expected to be smooth and without undesirable consequences. All so, however, there are some “buts” on the way.

To make it happen, you can’t do it with human efforts only, taking note of data volumes that must be processed, without target-specific tools that would aggregate your data quickly and qualitatively. And here’s where real estate investment management software has your back.

In this blog post, let’s explore how this type of software can take your business to a new level. Why it stands out from other real estate solutions, its benefits, must-have features, and limitations — go on reading to learn about these points.

Explaining the Essence and Upsides of Real Estate Investment Management Software

To better understand how exactly real estate investment and property management software can expand your business capabilities, let’s consider the case of our customer who turned to us recently. The company counts multiple departments, including capital investment, acquisition management, and property management.

Obviously, these units are closely intertwined, and the process goes the following way. The capital investments department raises capital from diverse sources, forms an investment fund, and approves deals. Acquisition management cooperates with brokers and property sellers to make purchases (i.e. finds the use for money allocated by capital investments or finds deals and capital markets provide a budget for that afterwards). Property management, in its turn, deals with maintenance and makes housing stocks suitable for rent.

Each department operates with huge datasets, and obviously, they must be accessible to other teammates so they can be on the same page. And that’s where the shoe pinches — they lacked centralized data storage and seamless transfer from one unit to another.

Their problem was that they used various kinds of software that did not communicate with each other in any manner. Plus, data exchange between departments was not fine-tuned properly, which entailed much trouble. Chaotic data storage, lack of automation, limited data analytics capabilities, and piles of manual workflows — all these hindered the company’s growth and affected the deals’ quality and closing rate.

That’s what real estate software for investors is designed for. This system optimizes investment-related processes from A to Z, and all the stakeholders are empowered to effectively manage their assets, quickly aggregate and analyze huge volumes of data, and of course, make informed decision-making at all levels. Let’s take a closer look at what such a system can exactly help you with.

Improved Pipeline Visibility

Deals, especially costly ones, can’t be closed fast. Each case is unique and requires proper coordination of the steps taken. But how to do that when there’s no timely data exchange and prompt deal status updates?

Real estate investment management software would help all stakeholders be on the same page. Starting from initial property evaluation and ending up with deal closure — the system will help you track deal progress and access the related documents and information, such as property details, financial metrics, and communication specifics with customers.

Quick and High-Quality Data Analysis

Profitable and efficient deal closure is impossible without proper analysis of real estate metrics, which can be easily done by property investment management software. When you plan an operation with real estate, there are dozens of property-related metrics you have to take into account — geospatial data, technical condition, infrastructure, and many more.

Entrusting data analytics to a human when millions of dollars are at stake is quite short-sighted and even risky. People are prone to errors and may overlook some critical details essential for high-quality analytics. The specific software will process all deal-related details, even seemingly minor ones, so you can gain a comprehensive report. Let alone the fact that the tool will do it in minutes, not in hours or even days as in the case with a human.

Routine Processes Automation

Imagine, you are being asked to do math in your head only — it’s forbidden to use support tools for these actions. How long would it take you to multiply five- or -six-figure sums and what is the probability of being mistaken?

With a calculator, it’s a matter of seconds, and you are 100% sure of the result you see on a display. The same thing is with the software: entrusting it with such routine tasks as calculations, invoice generation, task distribution and progress tracking, analysis, and reporting, you alleviate the workload of your field staff and speed up the entire process.

Find out why Businesses Embrace the Trend of Hyperautomation

Advanced Risk Management and Improved Decision-Making

The more scrupulous you are at risk assessment, the higher the probability of closing a profitable deal you have. But again, under ordinary conditions and with human effort only, processing tons of data (that must be found first), visualizing them, and preparing forecasts will take too much precious time. And possibilities of errors increase exponentially if you don’t use real estate asset management software.

As it was mentioned above, real estate software for investors is of great help in data analysis, deals’ progress tracking, and routine task automation. All these points eventually affect the efficiency of strategic and financial planning, which aids in risk mitigation in the long run.

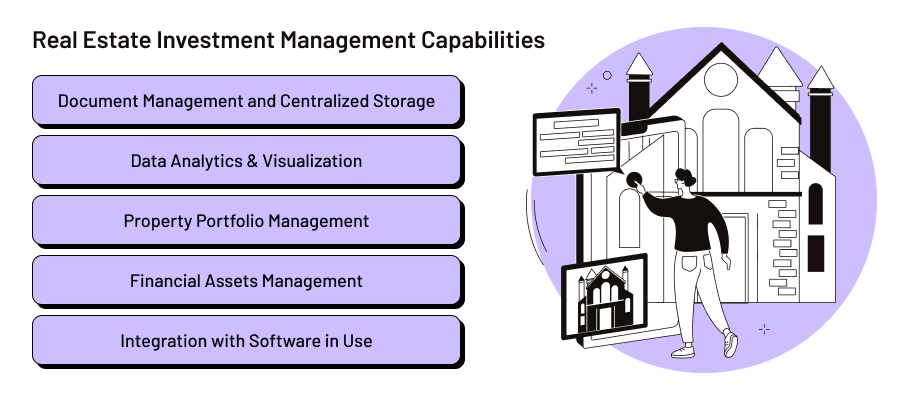

Real Estate Investment Management Software Capabilities: Must-Have Features in Focus

Document Management and Storage

Target-specific software can help to resolve the issues with chaotic data retention and inefficient management once and for all. The system offers centralized and secure document storage, so you may be sure about the integrity of your mission-critical investment- and property-related documents.

Moreover, its functionality allows you to create contract templates and update existing ones automatically, which makes the document flow a breeze.

Data Analytics and Reporting

Here let’s refer to a real-life example of our customer coming from the industry. Their firm provided data and consulting services to real estate companies, but the issue was that their software in use lacked analytics tools, and the client asked for our help.

Our engineers completed the task successfully and enriched the client’s system with analytics capabilities. As a result, the customer can process huge volumes of data, generate high-quality detailed reports on sales activities in the blink of an eye, and track the KPIs of their real estate agents.

Explore more details on the delivered Real Estate Data Analytics Solution

Property Portfolio Management

Real estate asset management software represents a centralized platform that you can use to manage the entire property portfolio of your company. It allows you to analyze the property’s profitability, identify investment-related risks promptly, and redistribute assets in the most efficient way.

Financial Assets Management

Capabilities of the real estate software for investors also incorporate financial administration and management. Expenses monitoring, profit forecasting, and detailed reports on all the operations related to the property, such as rental fees, utilities, and maintenance — all transactions are transparent and available for analysis.

Integration with Software in Use

It’s a rare case when real estate companies use only one type of software, as a rule, there are several of them. In the example of the customer we spoke about earlier — they had a CRM and several other systems for internal and external communication and document management.

Discover The Power of CRM and Document Management Systems Integration

However, the systems were not integrated with each other, which hindered smooth data exchange and didn’t allow all team members to stay on the same page in general. Properly designed property investment management software normally features APIs, which ensures flawless connectivity with other systems in use.

Read about 9 Types of Software to Connect CRM With

Easier Said than Done or System Implementation Challenges to Expect

Real Estate Investment Management Software Implementation Hurdles

Data-Related |

Integration with Other Systems |

|---|---|

|

|

Data Volumes and Heterogeneity

Yes, data is a precious asset, the more details you have — the more informed decisions you are empowered to make. But there’s also another side to the coin — the more data you operate — the more complex its processing is. All because of heterogeneity, varied data formats, and low-quality source data.

Above, we spoke about the data analytics solution we delivered to our client providing consulting services to real estate companies. Data volumes and consistency were the most painful challenge we had to overcome. The issue is that the customer extracts the information from multiple MLS, and their amount is about 400.

Just imagine the scope of work! All data must be filtered and transformed to a unified format to be suitable for analytics. Otherwise, you risk getting inaccurate reports in the end. Would you like to rely on misleading information when making decisions considering millions of investments? Very unlikely, and it’s totally understandable.

Review 6 Types of Data Analysis That Help Decision-Makers

Integration with Internal and External Systems May Be Not That Simple

If the system you want to integrate with has a separately developed API and is properly documented, establishing flawless communication is as easy as pie to handle. If not, it may turn into an adventure full of hurdles.

As a rule, internal software companies actively use is not always ideally documented. If so, the engineering team has to spend extra time on reverse engineering or communication with developers on that side. Sure thing, nothing is impossible, but you’ll have to allocate time and resources for this piece of work.

Considering external systems and databases — the problem is hidden in another place. Normally, well-known platforms, such as Booking.com or Airbnb are properly documented and open for integration, so it’s not a big deal to fine-tune data extraction from them. Problems start when you have dozens or even hundreds of sources you intend to pull out data from.

Explore more about Real Estate Integration Levels and Hurdles

If you need multiple databases to extract data, be prepared for the fact that each integration implies a separate API. All is simple here: the more APIs you need — the more you have to pay for their development.

Where Next? Real Estate Investment Management Software Future Development Vector

An exceptional level of automation is something real estate companies particularly eager to achieve in recent years. That’s why the trend of implementing Artificial Intelligence in the workflows of such companies is gaining momentum.

Consider the countless routine tasks that can be partially or fully automated by technology — from customer service to compliance and fraud detection. And imagine the chunk of resources you could redirect toward higher-value activities!

Also, when making a decision regarding real estate investments, it’s essential to have an understanding of its profitability level in the future. That’s where Machine Learning modeling can do a great job, but remember that maximally accurate forecasts become possible with big data volumes.

When making a forecast considering a property’s ROI, it’s not enough to use only current data, such as location, technical conditions, and maintenance costs. When you also include historical data, such as transaction history, the criminal rate in the district, and other similar parameters, you’ll gain a maximally precise prediction that will help you not to lose with the property you intend to invest in.

Bottom Line

Errors, wrong estimations, and disorganized workflows are quite costly when we speak about real estate investments. That’s why using advanced tools and systems that would help with process orchestration and efficient data management is not a whim in current realities but a must.

By adopting tailored real estate software for investors, you gain a chance to effectively use your inner resources and make informed strategic decisions. However, you need a reliable software development partner, well-versed in the intricacies of the domain and able to take into account the requirements of your business.

Velvetech has a proven track record of building real estate solutions and stands ready to turn your idea to life. Contact our team and share your vision, we’ll gladly help you out!