Embedded finance has exploded in popularity in recent years, altering and multiplying the ways how people interact with financial institutions. This transformative approach has changed the landscape of financial transactions, making banking services more accessible both for consumers and businesses.

By bringing together traditional financial products and seamlessly integrating cutting-edge technology, embedded finance opens doors to unprecedented growth and limitless potential.

According to Statista, the revenue generated by this sector in the USA is projected to exceed 230 billion U.S. dollars by 2025. This rapid growth highlights the enormous benefit and potential of this approach.

If you want to unlock new avenues for customer engagement, gain a competitive edge, and propel innovation within your industry, then you shouldn’t overlook leveraging embedded finance solutions.

In this blog post, we will delve into the concept of embedded finance, exploring its various models, key benefits, challenges, and opportunities it presents.

- What is Embedded Finance

- Popular Examples

- Benefits of Embedded Finance

- Common Challenges to Consider

- Emerging Trends to Follow

The Concept of Embedded Finance

This approach enables companies to offer financial services within their existing products without necessarily being traditional financial institutions.

With the adoption of embedded finance, businesses have tools to help their platform’s users with financing, payments, loans, insurance, savings, and more. All that without redirecting them to separate financial institutions or third-party platforms. The examples can be e-commerce stores, ride-hailing apps, or any other non-financial environments.

Key Types of Embedded Finance Solutions

There are various types of embedded finance solutions out there, each getting its niche in the financial market. You can use one of them or even mix some, depending on your business goals. Below, we will dive into the four most common categories, so you can choose the most suitable option for your company and pave the way for success.

Embedded Banking

With embedded banking, which is often referred to as banking as a service, businesses can streamline transactions, offer personalized solutions, and create seamless financial experiences for their customers.

A great example of such solutions are ride-sharing apps like Uber and Lyft. These two suggest embedded banking services to their drivers. As a result, they can receive instant payouts for their earnings and track their finances. Moreover, they can even access banking products like loans or savings accounts, all through the ride-sharing app.

Discover the top popular Uber-Like App Types

Embedded Payments

Decades ago, the idea of making payments with just one click seemed like a dream. However, embedded payments have turned this dream into a reality. With the advent of these solutions, customers can now conveniently complete transactions in the blink of an eye.

PayPal Checkout and Stripe Connect are excellent examples of embedded payments. These platforms empower businesses to seamlessly integrate payment processing into their websites or apps, facilitating smooth and uninterrupted transactions for customers within the app itself.

Learn more about the key benefits of Mobile Payment Gateway Integration

Moreover, embedded payment solutions often come with additional benefits. Some offer reward programs where customers can earn points or loyalty rewards for using the app to make purchases. It aims to encourage users to embrace this service as a preferred method of transaction. On top of that, it simplifies the shopping experience and boosts customer loyalty.

Embedded Lending

Imagine the situation when you need to apply for a loan. You usually have to visit a bank, prepare a pile of documents, wait in line, and generally spend a lot of your precious time. Let’s admit, it’s really overwhelming. But embedded lending makes this process go smoothly. You can apply for a loan or get a credit card right at the moment of purchasing products.

One of the good examples of this kind of solution is Afterpay. Customers can use it to make purchases and pay for them at regular intervals. Afterpay can be embedded within various e-commerce platforms, including online stores and mobile apps.

It is beneficial both for buyers and sellers. Embedded lending solutions attract customers by offering flexible payment options, thus driving sales and customer loyalty.

Embedded Insurance

The last type of embedded finance we want to cover is embedded insurance. To put it simply, it allows users to purchase insurance coverage directly within the platform that doesn’t relate to insurance solutions in the first place.

For example, when planning to travel, there’s no need to engage with an insurance company separately to purchase travel insurance. Instead, you can conveniently get it right within the platform you’re using to book your accommodation or flights.

Benefits of Embedded Finance

As we’ve gone through some examples of how embedded finance helps businesses seize new opportunities, you can assume what benefits it provides for organizations. If the picture is still not clear to you, no worries — we’re here to help you get the idea.

1. Enhanced User Experience and Convenience

By now you could already get the picture of the convenience of embedded finance. You see, in the past, you had to switch between multiple apps to make different transactions like applying for loans or making payments. While today, you can simply access different financial services within one platform.

That’s all thanks to embedded finance. By making financial operations fast and easy, this approach greatly enhances customer satisfaction and leads to a better user experience.

2. Increased Accessibility to Financial Services

Another benefit is that financial services become more inclusive and available with embedded finance. People who may not traditionally engage with standalone banking apps can now reach a wide range of services.

As we’ve said, that becomes possible due to the merging of financial tools with third-party platforms like marketplaces, delivery apps, or booking platforms.

Read about the Development of a Long-Term Care Booking System

3. Personalized and Targeted Offers

With the use of embedded finance platforms, businesses can personalize financial product suggestions to specific customer requirements and goals. In particular, by analyzing user behavior, transaction history, and preferences.

For example, a retail platform that has integrated embedded finance capabilities can analyze purchase history, browsing patterns, and demographic information to provide personalized credit card recommendations.

4. Potential for Revenue Growth

By adopting embedded finance and enabling financial transactions, companies can generate revenue through commissions, fees, or revenue-sharing arrangements with financial institutions.

On top of that, businesses can collaborate and partner with such institutions to foster innovation and expand their service offerings. This strategic approach creates more opportunities to reach the target audience and contributes to the company’s growth.

Embedded Finance Challenges and Considerations

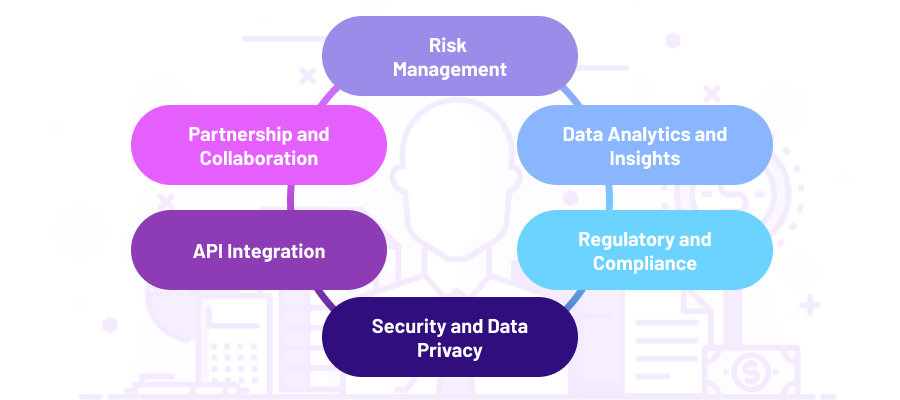

Embedded finance may appear captivating to implement due to the benefits it implies. However, it can be difficult. If you want to continue with this strategy, you should keep in mind the main considerations. Forewarned is forearmed, after all. Here are the most frequent challenges that you may encounter along the way.

1. Risk Management

Embedded finance solutions require robust risk management mechanisms to effectively mitigate potential challenges. Platforms can incorporate various tools like credit scoring algorithms or risk assessment models to address issues.

These tools can evaluate an individual’s creditworthiness based on various factors such as credit history, income, debt-to-income ratio, etc. Additionally, they can analyze a range of parameters to assess the likelihood of default, fraud, or other potential risks.

2. Data Analytics and Insights

Data analytics empowers companies to enhance user experience and deliver more relevant financial services. For example, it allows for providing personalized recommendations, budgeting tools, or investment suggestions.

Discover how to transform your business with an Effective Data Analytics Strategy

3. Regulatory and Compliance

Embedded finance deals with financial transactions and sensitive data. Hence, it should stay in compliance with different industry regulations and data protection laws. However, meeting the necessary legal and regulatory requirements to operate within the financial services industry can be complex.

Anti-Money Laundering (AML) is one of the regulations that financial platforms must adhere to. It aims to help prevent money laundering, terrorist financing, and other crimes.

Know Your Customer (KYC) is another regulation that is especially required for institutions that provide financial services like lending or investment. KYC helps verify the identity of customers and assess their risk profiles. It gathers necessary customer information and conducts ongoing monitoring of customer activities.

4. Security and Data Privacy

Ensuring user data privacy and security is one of the key challenges of the financial industry since it deals with vast amounts of sensitive information. Often platforms that integrate banking services become targets for cyberattacks and data breaches. Thus, it is important to implement robust security measures.

One of the ways to harness these issues effectively is by prioritizing data protection. For instance, you can implement encryption protocols, incorporate authentication mechanisms, and conduct security audits to prevent unauthorized access.

5. API Integration

You can’t leave out API integration if you decide to offer financial services within your platform. It enables the utilization of relevant data by third-party companies to create innovative solutions that go beyond what a bank can offer independently.

Such an API-first approach helps offer a broader range of services through connections with investment firms, budgeting apps, or personal finance management tools. By adopting it, businesses can build a scalable infrastructure that leads to efficient data exchange and interaction between various systems and applications.

6. Partnership and Collaboration

Partnerships with fintech organizations are critical for companies that decide to turn to embedded finance. Non-financial platforms frequently rely on such collaborations to offer underlying financial services.

Building and maintaining effective relationships can often entail some difficulties since it requires negotiating contracts, aligning business strategies, and addressing possible conflicts of interest.

Trends in Embedded Finance

Companies looking to leverage embedded finance should be aware of common market trends in this field. It will help you make well-informed decisions and stay competitive in the rapidly evolving financial landscape. So, before wrapping up our article, let’s explore some common trends in this industry.

Buy Now, Pay Later

Buy Now, Pay Later (BNPL) concept has changed shopping habits. With it, customers can buy a wide range of products without having to pay for them straight away. They can do it over a certain period of time.

Overall, BNPL services have become popular among individuals seeking convenient and budget-friendly payment options. It empowers consumers to access the goods they want while managing their finances more flexibly.

Point-of-Service Լending

This one is a new version of BNPL. It is specifically designed for larger purchases such as high-value consumer goods or even home renovations. Contrary to BNPL, POS lending usually entails an interest rate. On top of that, its repayment can last years and may require large monthly payments.

Open Banking

Open banking has paved the way for secure and consent-based sharing of financial data with embedded finance providers.

Through open banking, customers gain the ability to grant access to their account information to trusted third-party companies, including fintech startups and non-financial platforms. It lets users obtain a variety of financial services and benefit from personalized offerings that cater to their specific needs and preferences.

On top of that, open banking initiatives prioritize data security, ensuring that individuals have control over the sharing of their personal information. With clear regulations and robust security measures in place, users can confidently engage with embedded finance providers.

Decentralized Finance

Decentralized Finance (DeFi) is an emerging trend within embedded finance that leverages blockchain technology and cryptocurrency to create decentralized financial applications and protocols.

At its core, DeFi seeks to democratize finance by challenging the dominance of centralized institutions. It enables peer-to-peer relationships that facilitate a wide range of financial activities from everyday banking and loans to complex contractual agreements and asset trading.

Learn how we helped Create a Decentralized Exchange

Advancement in Technology

Integration of artificial intelligence and machine learning enables embedded finance platforms to forecast user behavior, identify trends, and provide relevant recommendations.

Overall, leveraging AI and ML algorithms provide numerous benefits. For example, it can enhance security measures and protect users’ funds. In particular, these technologies enable fraud detection and can prevent suspicious activities in real time.

Keep on reading How Artificial Intelligence Can Revolutionize Finance and Banking

Collaboration Between Fintechs and Non-Financial Players

Collaboration between fintechs and non-financial players is a growing trend within embedded finance. One of its main goals is to create innovative and customer-centric solutions.

Overall, this approach is beneficial for both financial and non-financial players. This collaboration enables non-financial companies to benefit from fintech expertise, gain access to a larger client base, improve the customer experience, and differentiate themselves in the market.

Fintechs, on the other hand, gain valuable distribution channels and the opportunity to reach a larger audience with their financial solutions.

Transform Your Business With Embedded Finance

We explored the key types, pros and cons, use cases, and common embedded finance trends. So, now you have a comprehensive understanding of its groundbreaking potential.

By integrating financial services directly into your platforms or applications, you can facilitate transactions, offer personalized financial solutions, and create new revenue streams.

If you’re ready to harness the power of embedded finance and need expert guidance or assistance throughout the development journey, our experienced professionals are here to support you. Feel free to contact us.