- Project: Developing a loan management system for enhanced financial transparency and smarter decision-making

- Duration: Ongoing

- Technologies: .NET 8, GraphQL, AWS, Jenkins, Bitbucket, MariaDB, Postgres, Redis, Elasticsearch, Kafka, Vue.js

The client offers a range of financial services for both businesses and individuals, specializing in debt recovery assistance and investment management.

THE CASE

Our team assists the client with an ambitious endeavor — migrating their obsolete and cumbersome monolithic system to microservices and modern technologies. This overhaul was essential, as the client had relied on the platform for over a decade, and its sheer size had made it increasingly difficult to maintain and scale.

At the client’s request, the Velvetech team developed a new microservice-based system and is actively migrating key functionalities from the legacy platform using a modern tech stack. In addition to the migration, we are enhancing the new platform with additional modules, including a loan management system software designed to connect borrowers with lenders offering help with debt restructuring.

The Client’s Request

Within their legacy CRM system, the client had a module intended for advance management, and nurtured an idea of supplementing it with loan management also. However, over time their client base has grown significantly, thus the amount of data and calculations has also increased.

Such growth turned out to be backbreaking for the legacy PHP5-based monolithic system, which resulted in frequent glitches and performance issues. Additionally, the outdated tech stack restricted the ability to enhance platform functionality as needed. These limitations prompted the client to consider developing a separate loan management module within a modern, microservices-based system built by our team.

Having already established a strong track record as a trusted partner, our team was the natural choice for the project. Instead of seeking a new vendor, the client confidently entrusted us with loan management system design.

Check out how we proceed with Monolith-to-Microservices Migration for the Client

The Process

Our team is developing a module that streamlines the connection between brokers and borrowers while managing the entire debt restructuring process. The system provides a comprehensive view of loan details and automatically calculates the payments a borrower needs to make over the agreed period with the broker.

Ensuring full financial transparency and precise loan calculations was a top priority. To achieve this, we chose .NET as the core technology, guaranteeing reliability, scalability, and seamless performance.

Backward Compatibility and Dynamic Fields Fine-Tuning

The client’s database holds a massive 2.5 terabytes of data, including crucial customer information. As we began system decoupling, we successfully migrated all data to new databases. However, since the client isn’t ready to fully retire their legacy system yet, the original database remains intact and actively in use.

Read how we conducted Stepwise App Migration for Customs Bond Service Provider

With the old CRM system still a key part of daily operations, seamless communication between both systems was a top priority. To achieve this, we developed a robust API that enables smooth data exchange, ensuring that all details recorded in the new system are accurately reflected in the legacy one.

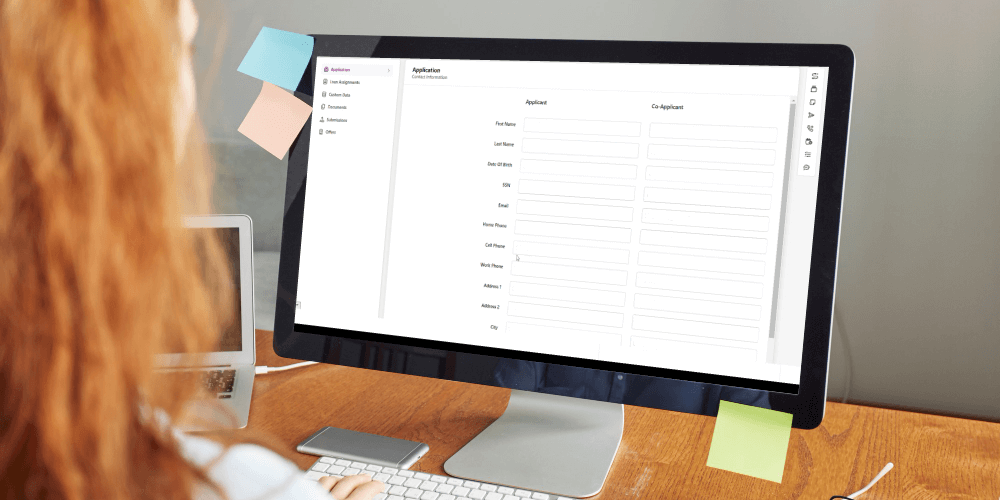

The system facilitates seamless connections between lenders and borrowers, both of whom are the client’s customers. To help both parties find common ground and negotiate optimal loan terms, our team implemented dynamic fields that allow users to capture essential details in a fully customizable way. Each client can tailor sections to match their specific needs, ensuring a personalized experience.

Once a form is completed, all entered data is simultaneously saved to both the new and legacy databases. In essence, our solution enables seamless, direct interaction with the databases through an intuitive interface.

Application Flow and Automated Status Update

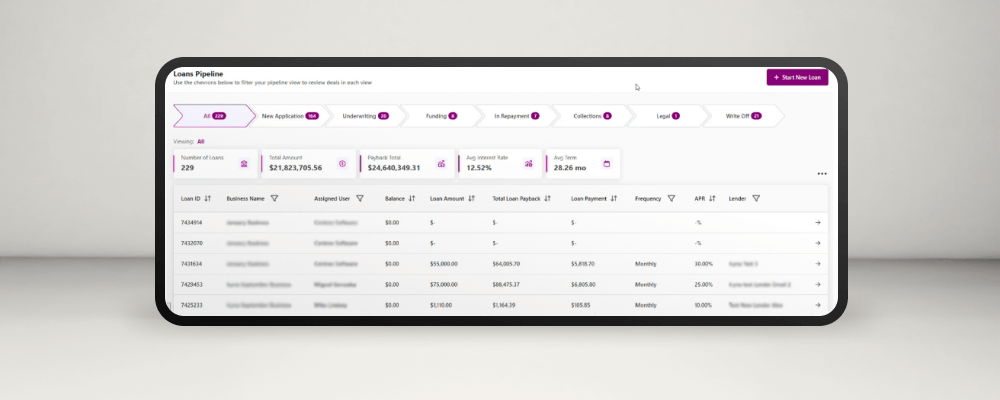

A key requirement from the client was to create an intuitive workflow with clear loan tracking capabilities. To achieve this, we designed a structured status system assigned to each contact within the platform, ensuring seamless monitoring of all active loans. Status transitions occur automatically, and once a loan reaches its final status, no further modifications can be made, ensuring data integrity and accuracy.

Additionally, we developed a dynamic pipeline that provides a high-level overview of each case. This includes essential details such as borrower information, assigned broker, loan amount, payment frequency, total loan repayment, and more — allowing for effortless loan management at a glance.

Personalized Offer Calculator

To enhance the customer experience, we developed a loan calculator that tailors unique loan offers. By factoring in the loan amount, repayment period, payment frequency, and additional commissions, the system computes the total repayment amount and interest rates and generates a personalized payment plan with clear chart visualization.

This allows both lenders and borrowers to have full transparency into the loan terms, making the decision-making process smoother and more informed.

Client Mobile App Development

The client prioritized user experience and wanted to give customers a seamless way to track loan statuses and stay updated on upcoming payments. To achieve this, we were tasked with developing a companion mobile app with a dedicated client cabinet.

Our team delivered both iOS and Android applications, enabling borrowers to monitor their loans effortlessly. Additionally, we implemented push notifications and automated email reminders — ensuring users receive timely alerts as payment due dates approach.

The Challenge

So far, we’ve built a system capable of managing loan pipelines, tracking statuses, and calculating payments. However, one crucial aspect still needs to be addressed — transaction management for loans. While we’ve already implemented this functionality for advances, integrating it into the loan module presents new challenges.

The new module introduces a range of unique parameters not present in the existing system, posing a risk to its stable operation. As a result, we may need to develop a fully custom transaction management solution tailored specifically for the new module. The process is further complicated by evolving client requirements, adding another layer of complexity to the implementation.

Outcome and Future Plans

After thorough testing, calculations refinements, workflow optimizations, our engineers have successfully deployed the loan module. The client gained confidence in the reliability of the new system, made sure that all features function seamlessly, and is now onboarding real users.

However, discussions regarding transaction management implementation are still underway. Once this aspect is finalized, we’ll integrate this feature to further enhance the module.

Our specialist will contact you to schedule a personalized consultation within one business day.

Velvetech offers complimentary consultations; after which, we will provide you with a proof of concept in just 3 days, an accurate outlook of the cost and timeline of your project and a competitive estimation, and an assembled team – ready to start your project within 7 days.

Proof of Concept in

Start Project within