Custom FinTech Software Solutions of Any Complexity

- Payment Solutions

- Financial Management

- Lending Solutions

- Investment and Wealth Management

- InsurTech

- RegTech Solutions

Payment Solutions

Payment Gateways

Our payment gateway solutions encrypt sensitive information, ensure seamless integration with ecommerce platforms, and provide real-time authorization and fraud detection.

Mobile Payment Apps

Offer on-the-go payment capabilities to allow users to make purchases, transfer funds, and manage finances with enhanced security features.

POS Systems

Leverage POS systems to integrate payment processing, inventory management, and customer relationship tools into a single and user-friendly interface.

Peer-to-Peer Payment Apps

P2P apps simplify personal financial transactions by enabling quick and secure money transfers directly from bank accounts or digital wallets.

eWallets

Modern financial solutions like digital wallets support contactless payments, storing loyalty cards, and managing finances from mobile devices.

Cross-Border Payments

Our fintech development team delivers software that includes features like multi-currency support, exchange rates, and compliance with global regulatory standards.

Financial Management

Personal Finance Management

Support individuals with tools to manage their finances, including tracking expenses, handling budgets, and planning for future financial goals.

Enterprise Resource Planning

Our team, skilled in software engineering, builds ERP systems tailored to financial business to provide a unified view of organizational data and enhance operations.

Accounting and Billing Software

Automating financial record-keeping, invoicing, and payment processing helps you ensure accuracy and compliance in transactions and reporting.

Tax Management Software

Level up tax preparation, filing, and compliance processes with software designed to automate calculations and manage deductions and credits.

Payroll Management Software

We’ll help you achieve effective payroll processing where accurate employee salary calculations, tax withholdings, and disbursements are no sweat.

Data Encryption and Protection

It’s impossible to do without data protection today, which secures sensitive information during both storage and transmission — we know how to ensure data confidentiality and integrity.

Lending Solutions

Loan Origination Systems

The right LOS software contributes to improving prospecting so that banks can find qualified borrowers, reduce risk, and avoid fraud.

Loan Management Systems

Banks and other financial institutions need proprietary platforms to automate time-intensive processes of managing payments and loan collection.

Lending Automation

From application and underwriting to approval and disbursement, lending automation tools enhance efficiency and customer experience and reduce errors.

Debt Collection Software

Streamline the process of tracking, managing, and recovering overdue payments from debtors efficiently and in compliance with regulations.

Merchant Cash Advance

We have experience in building efficient tech solutions that help companies leverage MCA and support this popular type of business financing.

Credit Scoring & Risk Assessment Tools

We equip credit unions, microfinance, and leasing companies with tools to evaluate the risks associated with loans, credits, and lending.

Investment and Wealth Management

Portfolio Management Systems

With quantitative and predictive forces, we deliver systems that optimize investment portfolios and fuel trades with precise market data.

Robo-Advisors

Go for Velvetech’s robo-advising algorithms that will help keep your wealth management solutions utterly personalized and highly effective.

Trading and HFT Platforms

Our team designs robust platforms, including FPGA-based solutions, to help businesses scan the markets and automate trading operations.

Alternative Investment

We develop full-featured platforms that comprise mobile and web solutions to manage alternative investments, including merchant cash advance.

Brokerage Solutions

We implement know-how portfolio balancing solutions that connect optimal trading service recommendations with brokerage firms.

Risk Management

Custom dashboards, stress-testing engines, and scenario analysis give you a leg up in identifying, assessing, and mitigating portfolio and market risks.

RegTech Solutions

Fraud Detection and Prevention

By implementing advanced algorithms and real-time monitoring, we’ll help you identify and mitigate fraudulent activities, which is a safeguard for your financial assets and transactions.

Anti-Money Laundering Systems

Monitor transactions for suspicious activities, perform risk assessments, and ensure compliance with regulatory requirements by adopting AML software.

Know Your Customer Solutions

Make sure only authorized individuals have the appropriate permissions by controlling and monitoring user access and adopting effective authentication mechanisms.

Identity and Access Management

Make sure only authorized individuals have the appropriate permissions by controlling and monitoring user access and adopting effective authentication mechanisms.

Compliance Management

Modern RegTech solutions help improve adherence to regulatory requirements and industry standards by automating compliance processes, tracking obligations, and ensuring accurate reporting.

Audit and Reporting

If you lack transparency and accountability, there are comprehensive audit and reporting tools that will help you track, document, and analyze financial and operational activities.

InsurTech

Policy Management Systems

We have a long history of developing software for the insurance sector, helping with policy creation, issuance, renewal, and cancellation.

Underwriting Software

With data analytics and machine learning in place, underwriting solutions evaluate applications quickly and accurately, which elevates the entire process.

Claims Processing Systems

If you deal with insurance claims, you know their processing requires some effort — with the help of technology, you can easily improve the workflows.

Key Financial Software Development Services

FinTech Consulting

Velvetech will lead you through technological advancements, design a smart IT strategy, and make your next financial software project excel operationally.

FinTech Systems Integration

To ensure all elements of your architecture work effectively, data flows seamlessly, and processes run smoothly — our systems integration expertise is at your service.

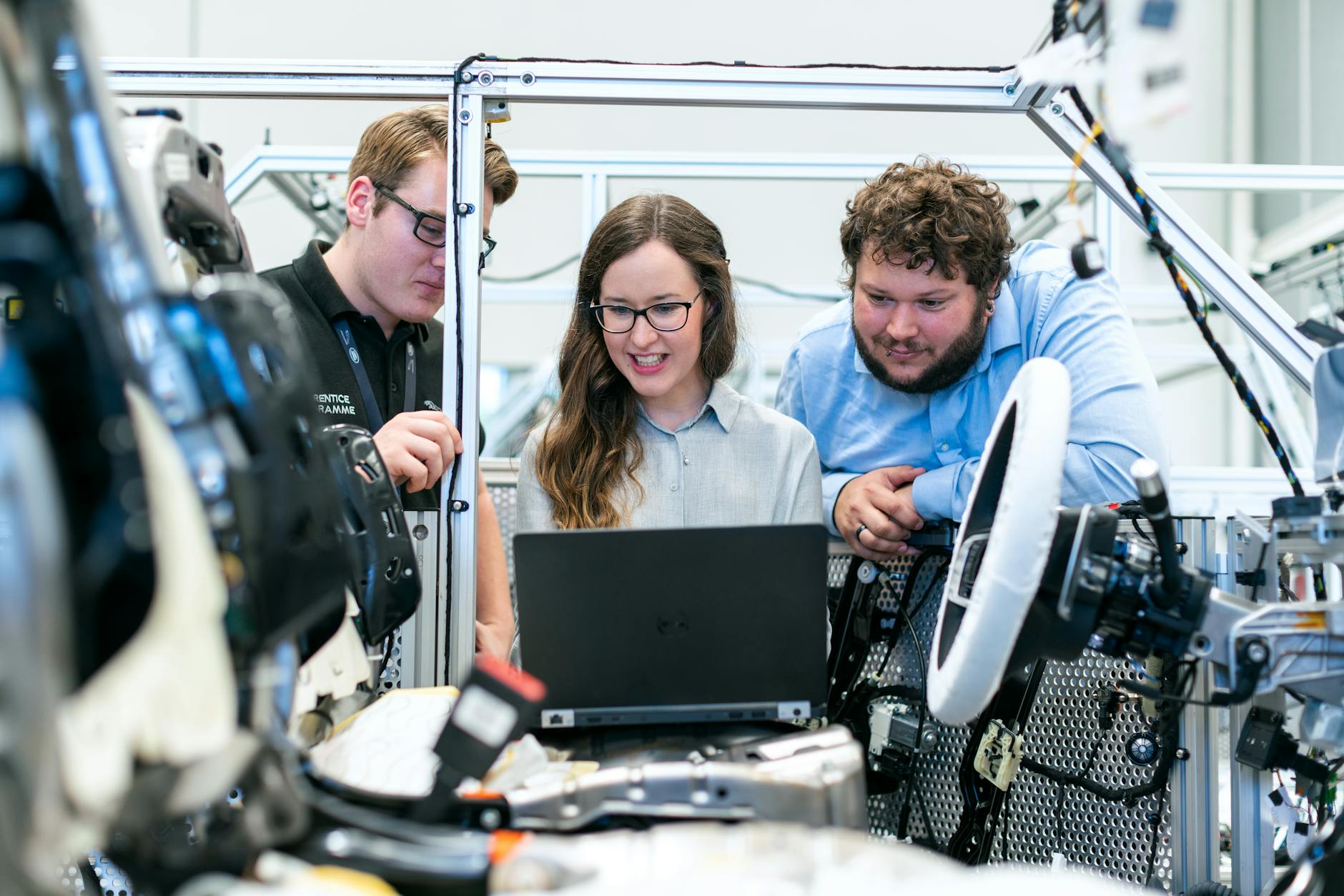

Custom Financial Software Development

Our company provides a range of software development services to help financial institutions craft custom digital solutions aligned with their must-haves

Financial Software

Modernization

Whether you seek to modernize your existing infrastructure to better align with your current needs or get away with legacy solutions, our support is dedicated to your goals.

Feel the power of automation with FinTech

software

START NOW

Yes, our team specializes in integrating fintech solutions with various banking APIs, payment processors like Stripe or Plaid, KYC/AML providers, credit bureaus, and other third-party services. This way, we ensure your operations are secure and consistent.

End-to-End FinTech App Development Company

Over 20 years, we’ve been delivering services in financial software development. Our mission? To help businesses fuel growth, draw in customers, and optimize operations. We stand at the forefront, delving into enterprise systems, IoT products, FPGA technologies, and advanced data analytics techniques.

Velvetech will support you with the right solution compliant with key financial regulations like Dodd-Frank or Sarbanes-Oxley to ensure maximum security. If you’re looking for a reliable partner to provide you with financial software development services, our team is ready to accelerate your project delivery.

- Deep domain knowledge

- Regulatory compliance expertise

- Enterprise-grade data security

- Fast time-to-market

- Solutions designed to maximize ROI

Accelerate your FinTech initiative!

SCHEDULE A CALLOur Clients are the Finalists of Benzinga Global Fintech Awards

CEO Credits His Success to Tech Innovation

Watch as CEO Ted Devine of Insureon, named Inc. 500’s #1 fastest growing insurance company, details how a trusted tech partner and a solid strategy shot his business past the competition.

Delivering Value for Your Financial Sector

Credit Unions

We build advanced fintech software solutions for seamless operations, better customer experience, and robust security and regulatory compliance.

Investment and Asset Management Firms

With real-time data analytics, AI-driven portfolio management, and risk assessment tools, we help optimize investment strategies and maximize returns.

Fintech Startups

Design innovative fintech solutions backed up with scalable and flexible tech stacks that enable rapid product development and seamless integrations.

Stock Exchanges and Brokers

We’ll help you ensure efficient market operations that incorporate real-time data processing, HFT capabilities, and stringent regulatory compliance.

Wealth Management Firms

Enhance services like personalized financial, estate, and tax planning, investment advice, or legal assistance by turning to our fintech experts.

Credit Card Issuers & Payment Processors

Fraud prevention, authorization and settlement processing, transaction security — all of that and more is available with comprehensive software.

Consumer Finance Companies

Our developers help alternative lending businesses like P2P and traditional consumer credit providers address their needs and services through software development.

Regulatory and Compliance Bodies

We follow the changes in financial regulations and provide technology solutions for automated compliance monitoring, reporting, and risk management.

Yes. We provide continuous support after launch, including bug fixes, security updates, performance optimization, and feature enhancements. Our goal is to keep your fintech product secure, compliant, and scalable as your needs change and business grows.

We Know FinTech Regulations and Standards

We’re here to drive secure FinTech

development

TALK TO US

Finance Software for Trailblazers

Blockchain & Cryptocurrency

Cryptocurrency exchanges, blockchain infrastructures and apps, digital wallets, and more — distributed ledger technology and smart contracts come to the rescue.

FPGA-Based Hardware Acceleration

With a combination of low-latency networks, high-performance computers, and FPGA hardware acceleration, you can complete trades in nanoseconds.

ML & AI-Based Fintech Software

We help financial firms use predictive analytics software and data science to manage market data flow, validate the accuracy of high-frequency trades, automate KYC procedures, etc.

Internet of Things

Empowered by IoT technology, smart sensors, generating and exchanging data bits within big data platforms, allow us to develop better risk management and trading solutions.

Mobile Financial Apps

Our mobile experience encompasses a wide range of mobile solutions for fintech: from mobile lending to investment advising apps with a social networking component.

Intelligent CRM Systems

Our financial software developers are ready to apply speech recognition, AI-powered communications, and other smart technologies and integrations to customize your CRM.

GenAI and RPA Tools

We harness GenAI solutions and leverage RPA to automate repetitive tasks and complex decision-making processes for our fintech clients who want to reduce manual effort

Cloud Technology

Innovate rapidly and achieve maximum flexibility with cloud solutions that offer scalable resources, enhanced security, and improved accessibility to your assets.

Financial Data & Analytics

We incorporate quantitative analysis, BI tools, and predictive analytics to build effective data models and boost your capability to manage data-driven processes.

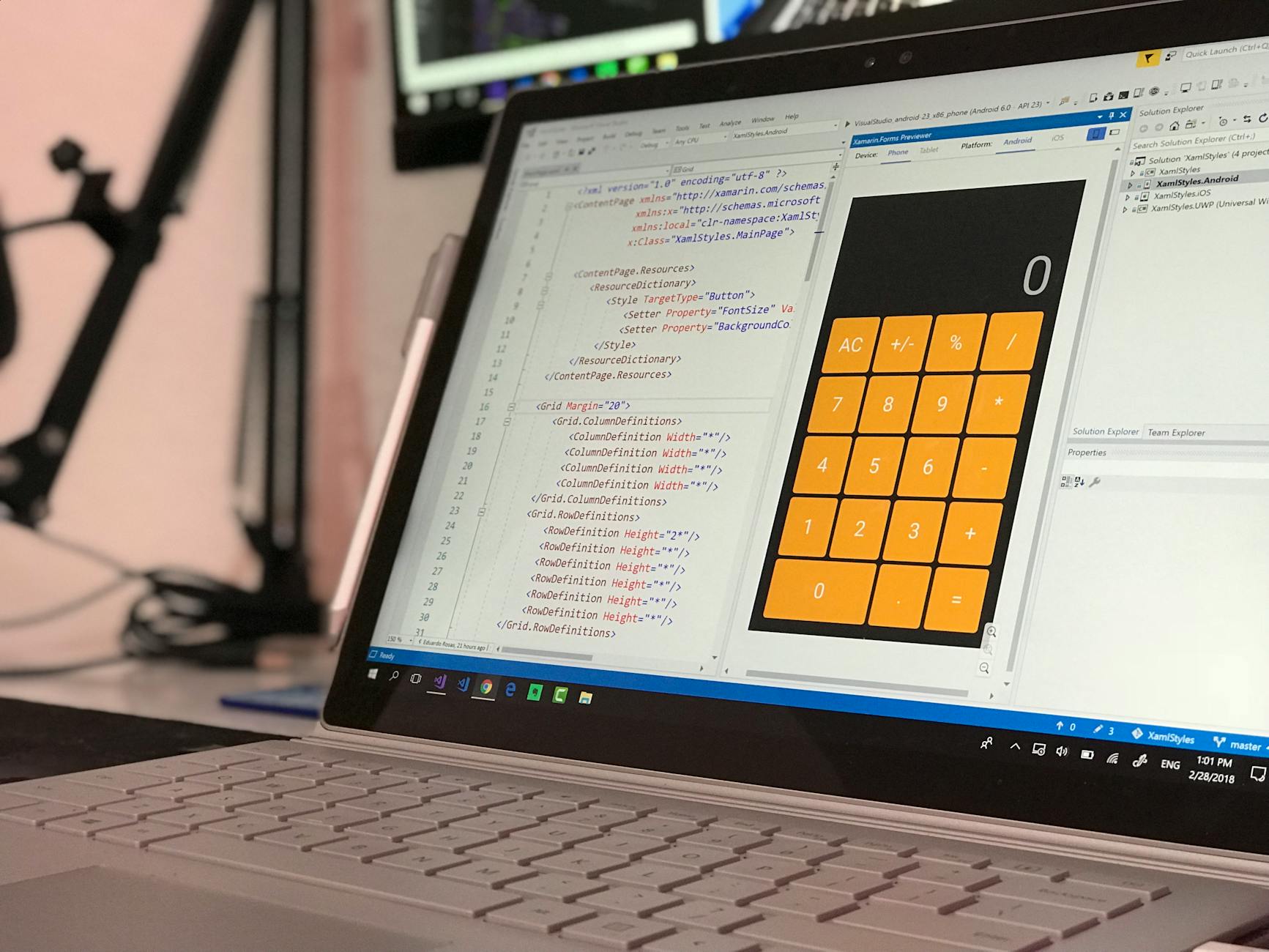

FinTech Software Development Cost

A straightforward financial application, like a personal budgeting app, with core features such as transaction tracking, basic integrations and reporting, and essential user interfaces.

A more complex financial system, for example, mid-sized business accounting software, that includes detailed analytics, multi-user support, custom integrations, and enhanced security.

An advanced platform, such as an enterprise financial management system, that can feature AI-driven analytics, automated compliance, and advanced integration with third-party services and solutions.

Our team will provide a detailed estimate according to your unique financial technology needs.

GET A QUOTEThe app’s complexity, features, and compliance needs define the development timeline. A basic MVP can be delivered in 3-6 months, while more advanced solutions may take longer. We also offer phased development to accelerate time-to-market.

The Powers of FinTech Solutions

With the development of financial software, fintech businesses gain a number of benefits that help drive the industry forward. Depending on the goals and the technology leveraged, companies improve customer experience, mitigate cybersecurity risks, win the competition, and more.

- Regulatory Compliance

- Cybersecurity Threats

- Technology Integration

- Data Management and Privacy

- Scalability

- Customer Trust and Retention

- Financial Inclusion

- Operational Efficiency

- Innovation and Competition

- Market Volatility

Ready to start your FinTech project?

REQUEST A QUOTEWith a long history of software development for finance and banking prior to establishing Velvetech, its founders gained extensive experience delivering solutions for this industry. Knowledge of the FinTech sector nuances and technology expertise allowed them to successfully implement projects for many clients and establish long-term partnerships with them.

Our developers continue to build custom applications that help organizations streamline operations and facilitate services. While outsourcing the design and delivery of their software, our clients — from trading and investment management companies to credit unions and other firms — acquire new tools to address their needs.